Have you ever considered turning to foreign markets to make some serious cash?

Have you ever considered turning to foreign markets to make some serious cash?

As the U.S. stock market continues to dish out profits, there’s other markets that could pay you even bigger profits.

The U.K. market in particular has made some extremely profitable moves, and luckily for us there’s an exchange traded fund (ETF) that tracks the movement of one of the U.K.’s most desirable composites.

Thanks to this ETF, making profits from international markets has never been so easy…

Have you been keeping up with current market conditions across the world? You have to always remain aware of where you can turn for the biggest possible profits.

While the U.S. market continues its big bull rally, there’s another market that could provide you with even bigger gains.

After the U.K. Prime Minister Theresa May called for a snap election last week, the FTSE 100 ($FTSE)—the major U.K. index—dropped 2.3% in a single day.

As this drop happened, many investors feared that the U.K. market would continue to plummet until the snap election on June 8th.

But that doesn’t seem to be the case anymore.

The FTSE 100 has reacted very positively to the surprise that came in the first round of the French election.

Investors rejoiced when it became clear that centrist candidate Emmanuel Macron—a strong supporter of the EU and its free trade policies—became the front runner to lead the European giant’s government.

The reaction in the markets across the globe has been very positive, but the FTSE 100 reacted in a big way.

The day after the news of the first round of the French election was announced, the FTSE jumped back up 2.2%.

While all these factors play a very significant role in the index’s positive movement, there were two factors that would’ve told us ahead of time what the chart might look like.

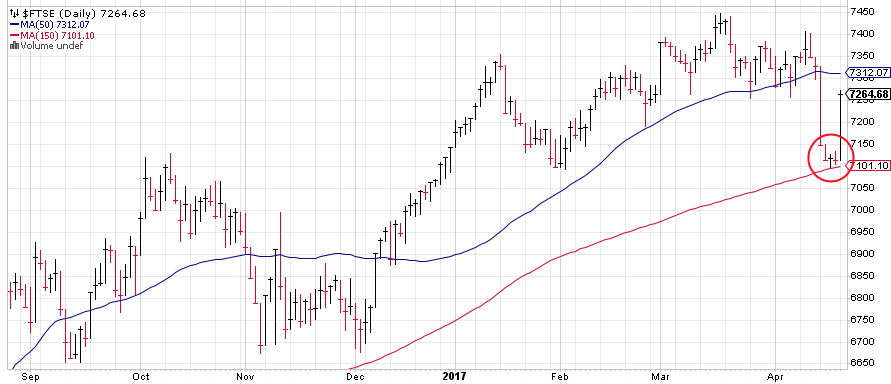

If you look at the chart for the FTSE 100 below, you’ll see I’ve circled the exact moment when the stock bounced off the 150-day moving average (the red line).

This is also very interesting considering the fact that the stock also bounced off that same line in December. The more bounces off the 150-day moving average, the more you can trust that it’ll bounce again the next time it approaches it.

But you’re probably wondering how you would’ve profited off this bounce, and how you can profit off it next time…

That’s where the Vanguard FTSE Europe ETF (VGK) comes in. VGK is an ETF that tracks the FTSE 100 (along with some other European indices) and trades on the New York Stock Exchange—that means that almost all American brokers will allow you to trade it.

VGK holds the second factor that would’ve predicted a profitable bounce.

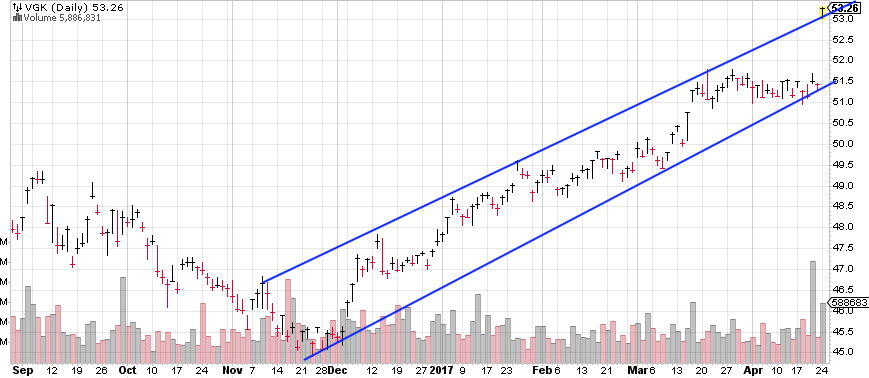

If you look at the chart for VGK below, you’ll notice the two blue lines that I’ve drawn. These two lines have outlined a channel that the stock’s price bounces between.

If you look closely, you’ll see that the price was sitting right on the lower channel indicating a “buy” signal over the past few days (when the price approaches the upper line you’d want to sell).

But, after this “buy” signal was flagged, the price broke above the upper line of the channel, which is an extremely bullish sign.

This means that the upper trend line that you see in the chart could now become a lower trend line as a new channel forms.

If you would’ve bought 100 shares of VGK after seeing both buy signals you would’ve collected a $5,326 payout—even more if you would’ve traded options.

As Europe heads into a time of frequent elections across its continent, I’ll be keeping a very close eye on VGK and I’ll let our Highfliers Hotline subscribers know when we come across the next “buy” signal.