If you could see into the future, what would you look for?

If you could see into the future, what would you look for?

The obvious answer is prices of stocks. You’d then be able to pile all your money into the stocks that you know for certain are heading up.

Of course, that’d be the biggest series of payouts you’ve ever seen, but I have something just as good, and to ensure you how profitable this will be for you, I’m going to explain why the market heavyweights are investing in it…

Whether you’ve been keeping a close eye on the stock market or not, you’ll have certainly heard of the crises that Chipotle (CMG) has been battling with over the past few years.

The initial issues they faced were solely revolving around their mishaps with e-coli and norovirus.

But these issues obviously turned into much bigger financial pitfalls.

Chipotle stock lost over half its value from August 2015 to October 2016, pulling its stock down to a 3-year low.

This obviously scared investors off, but things have changed quite a bit in recent times.

Now, normally we wouldn’t listen to the investors’ “expertise,” but in this case, the opinions of the heavyweight investors interested in the stock line up with the stock’s chart.

To me, that’s an “all the stars aligned” type of deal.

Before I get to the chart, let me point out the interest Chipotle has seen from the big-shot investors…

- Pershing Square Capital Management bought $1 billion worth of Chipotle stock in July, 2016.

- Cornerstone Advisors recently upped their initial stake in Chipotle by 122.3%.

- Ruane, Cunniff & Goldfarb recently disclosed their Chipotle investment to be worth around $203,614,000.

- Chipotle Director Matthew H. Paull increased his stake in the company by $158,084

- Data research firm M Science published a report stating that Chipotle’s same store sales grew by 20% in 1 month.

- Orbital Insight, a data company that scans the growth of customer cars in any given company’s parking lot, forecasted that Chipotle was staging a strong revival.

These investment giants and data experts are a great indication that the company is heading back up, but there’s a more significant sign that can be found in its stock’s chart that tells us exactly where this company is heading.

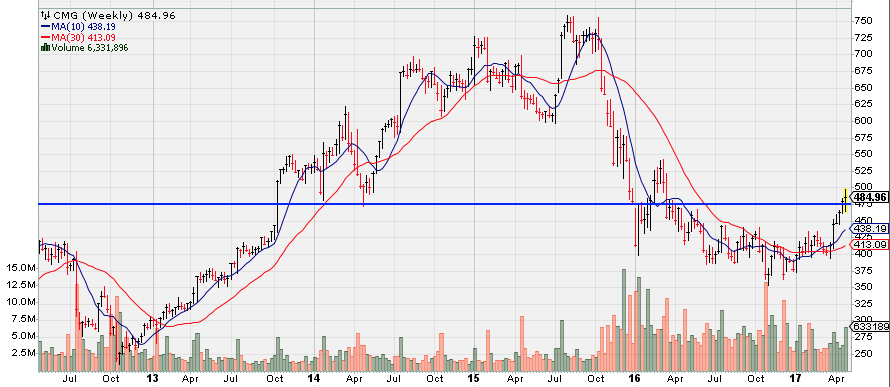

Take a look at the weekly chart for Chipotle below.

You’ll see that I’ve drawn a horizontal blue line across the middle of the chart around the $475 mark.

You’ll notice that throughout various stages of this chart, the stock stalled around the $475 mark, and most of the time it failed to break below or above it depending on the time.

In the midst of all the big investments, Chipotle finally broke above that $475 mark when it recently blew its earnings expectations out of the water on 4/26.

Not only is this a very bullish sign for the stock’s future, but the buying and selling volume (grey and red bars, respectively) indicated how strong this move was.

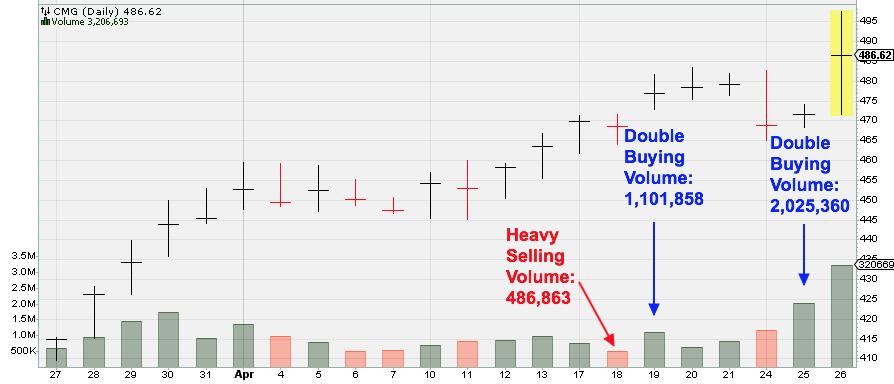

Take a look at the daily chart that I’ve zoomed in on below.

You can see where I’ve outlined three different volume bars in the past week.

The first bar I’ve highlighted on 4/18 is a selling-heavy bar. There were 486,863 shares of Chipotle traded that day, and the selling outweighed the buying (making the bar red).

The next bar I’ve highlighted is for the next day, 4/19. As you can see the volume doubled to 1,101,858 and it was buying-heavy. This was also the exact day that Chipotle pushed above $475 for the first time in a while.

The third bullish sign came on 4/25, the day before earnings. Volume then just about doubled again to 2,025,360, and was also buying heavy.

After this last volume spike, the price of Chipotle jumped up 6% in a single day.

Now that this stock has broken that $475 barrier, and all these big investors are back on board, I wouldn’t be surprised if we see Chipotle reaching the heights of $750 per share, back up to where it used to trade at during 2015.

Great info and a well written article. Thank you!

Chuck