Before elevators and escalators, the only way to walk up from point A to point B was to take a flight of stairs.

Before elevators and escalators, the only way to walk up from point A to point B was to take a flight of stairs.

The thing is, pulling profits from the market isn’t all that different…

You can apply a stair-step approach to stocks as a way to determine which investments are moving up and worth getting into.

Using this very same tactic on NRG Energy (NRG) would’ve emptied a 315% gain straight into your portfolio!

Here’s how you could’ve spotted it ahead of time.

One of the best ways to recognize these stair-stepping-stocks is to see a real world example played out.

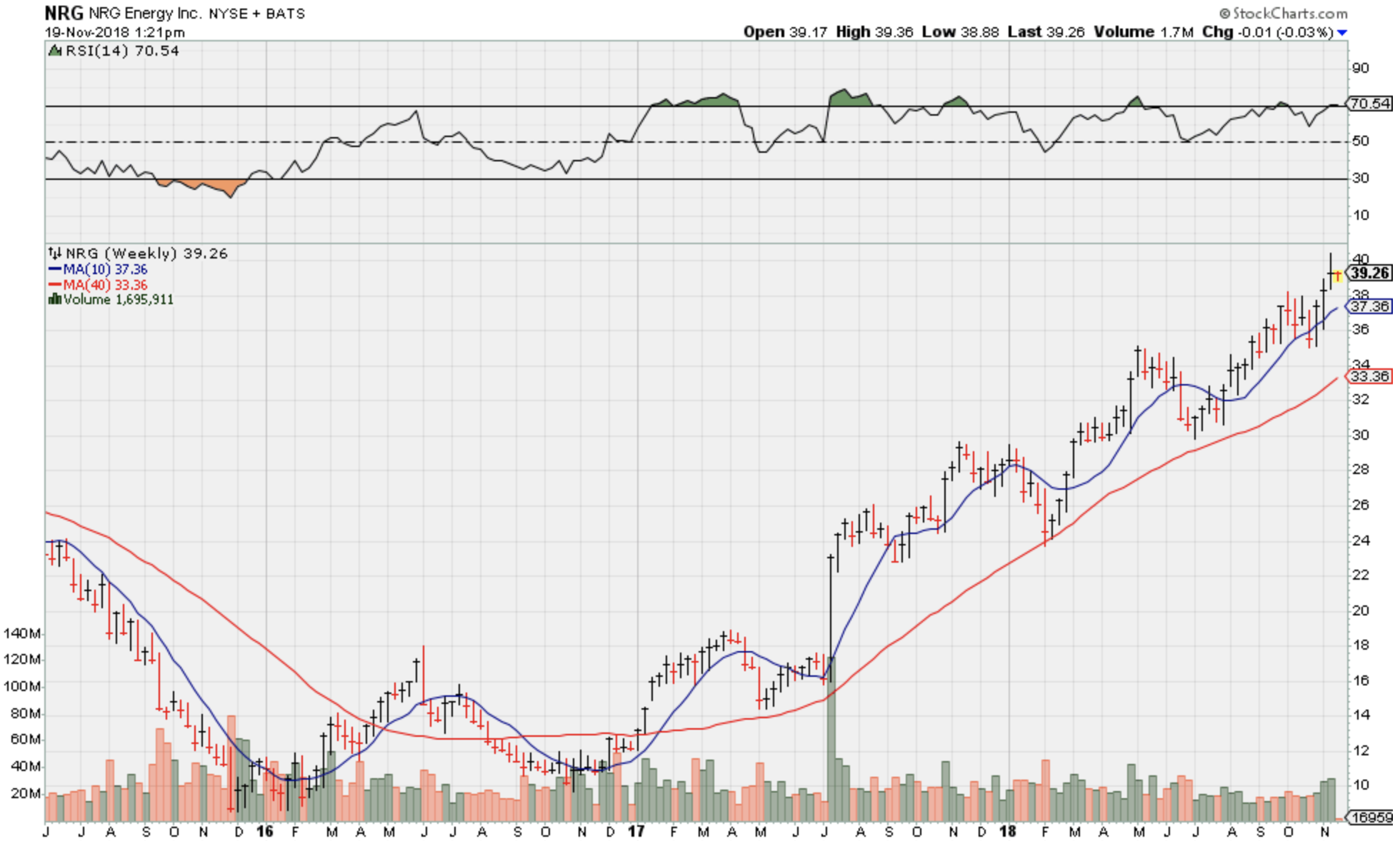

With that said, take a look at the chart for NRG Energy (NRG) below…

One of the first things you’ll notice is that NRG stock is in a solid uptrend… and it has been since the tail-end of 2016.

Over the course of the past couple years, company shares have produced more than 300% profits!

Now, you may have picked up on a few dips in values here and there, but these drops are exactly what caused NRG Energy’s price to jump from just under $10 to the $40 it’s hovering around at my time of writing this.

Without fail, every time the NRG price tag fell to the 40-week moving average (red line) it’s value immediately shot back up!

This is where the stair analogy comes into play…

As the stock travels upwards in price, these so-called “bounces” eventually start to form a pattern and look a bit like a set of stairs.

Being able to use this stair-step strategy can easily give you the upper hand along Wall Street.

And if you happen to miss a good buy-in point, you can always use these dips to your advantage. Simply purchase shares at the low of these price drops and take the stairs to the peak of its increase.

In this case, following NRG up, step-by-step would’ve QUADRUPLED your initial investment!

The next time you’re looking to pour some funds into the market, take a minute to scan the stock charts for these stairstep patterns.

Just remember to keep an eye out for recurrent bounces off the 40-week moving average and check to make sure the overall stock is at an upward trajectory.

If you’re able to spot one, there’s a good chance you’ll have some profits to show for being a shareholder.

Afterwards, feel free to climb your way up to increases, similar to NRG’s 315% gain.