The vast majority of investors are only interested in quick turnarounds from the market or the latest and greatest get-rich-quick schemes.

The vast majority of investors are only interested in quick turnarounds from the market or the latest and greatest get-rich-quick schemes.

But if the story of the tortoise and the hare taught us anything it’s that slow and steady wins the race.

NRG Energy Inc. (NRG) may not be the fastest way to flip cash on Wall Street, but it’s definitely the SAFEST and most PROFITABLE if you’re in for the long haul.

Here’s a closer look at NRG’s performance over the past few years and why you should consider adding it to your stock portfolio.

When it comes to separating good buy-ins from the bad ones, you can boil things down to 2 main factors:

1. The company’s share price must be above the 40-week moving average.

2. The trajectory of the stock itself must be in an uptrend.

If you’re able to tick those two boxes off, then the odds of making money from the market are in your favor.

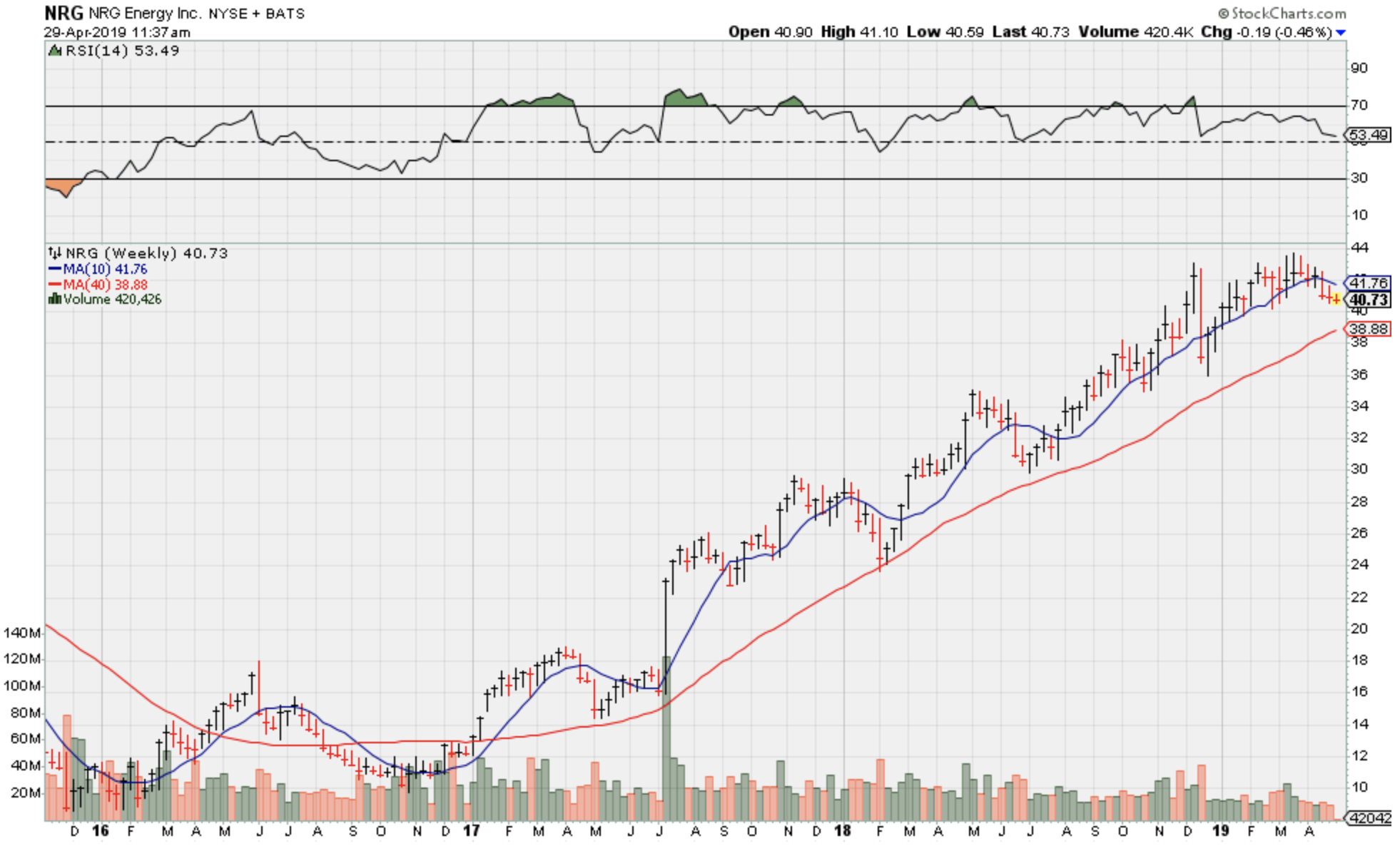

So, lets pull up the chart for NRG and see what we’re working with…

For starters, the current stock value is well above the red line, depicting the 40-week moving average, and shares have consistently been climbing higher and higher.

It’s a healthy chart to say the least, but what makes it even more interesting is the fact that it’s been able to maintain this uptrend for YEARS!

At the start of 2017, NRG was priced at $12.19 per share, but now it’s stock value is sitting somewhere around $40 a pop!

If you do the math, that’s more than 200% in profits, meaning that becoming an NRG shareholder two and a half years ago would’ve TRIPLED your original investment!

I guess it really does pay to wait. The thing is, this rally appears to be far from over…

So if you missed out on these profits the first time around, you can still hop in the trade and ride out the rest of this uptrend for who knows how long.

If you look back at the chart, you’ll noticed that values have managed to bounce off of the moving average time and time again.

This red line is essentially support for NRG’s stock and every time price fluctuations come around they never dip below it.

From 2017 on, this line of support has been in place and I think it’s safe to say that NRG is a trade that’s worth your while.

Shares grew almost 80% throughout 2018 and a little over 100% the year before!

On top of that, the company pays out a quarterly dividend to its investors. So if these profits alone weren’t enough to win you over, then maybe this will be.

All in all, buying into NRG now may prove to be just as rewarding as when this bull rally first kicked off.

Only YOU can decide what trades you want to add to your portfolio though.

All I’m saying is the steady performance and profits that NRG Energy Inc. brings to the table is something you might regret passing up.