Chances are if you keep up with the news at all you’ve heard about ‘crude oil.’

Chances are if you keep up with the news at all you’ve heard about ‘crude oil.’

While you might be uncertain as to what exactly crude oil is or why it impacts you, you should concern yourself with the potential money windfall that could be available to you.

We’re not talking any old windfall either—the stock I’m bringing to you has shot up over 443% in just a year!

Gains like that are life-changing, and you do not want to miss out a second time.

Before we get into how you can be making those RIDICULOUS gains, let’s talk for a second about what exactly crude oil is.

Simply put, crude oil is a naturally occurring, unrefined petroleum product made up of hydrocarbon deposits and other organic material.

Crude oil can be refined to produce things like gasoline and diesel, which is why it’s ben such a hotly discussed topic as of late.

As you’ve probably noticed, gas prices have slowly been creeping back up.

While we may only be feeling a couple cents’ difference at the moment, when you look at the bigger picture of oil prices, it becomes a bigger deal.

A year ago, the price of a barrel of oil was sitting at $46.08. Last month, the price of oil had reached $71.84/ barrel!

That’s clearly a significant difference, and while the price of oil may not continue to climb at such a steep rate, it’s likely that it will still continue going up.

After oil prices plummeted in 2014, countries were careful to regulate production to protect against a similar crisis of supply and demand.

While we may not be happy that our gas prices are going up, we should be happy that this presents some excellent opportunities for massive gains.

Let’s talk about that 443%-gainer I mentioned earlier.

The company is ION Geophysical Corporation (IO) and it’s a leading provider of geophysical technology and services and solutions for the global oil and gas industry.

As previously stated, IO has climbed over 443% from a year ago, which is truly some unbelievable growth.

Already in 2018 IO has gone up 19.8%, making it a far better performer than the industry as a whole which has only gone up 7.5%.

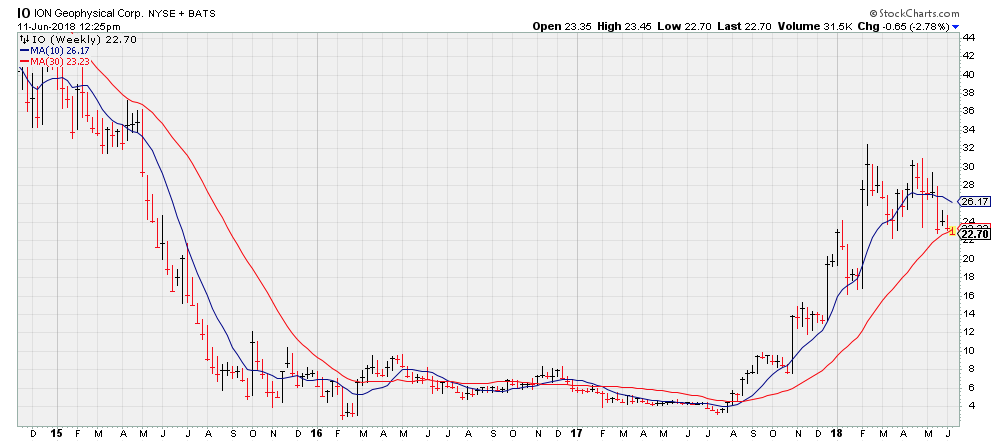

If we take a look at the weekly chart for IO, which looks like an almost perfect Phoenix stock at the moment of writing.

Looking at IO’s chart, it seems to pretty much follow the price of oil.

We can see that it began its fall downward in 2015, as did the price of oil, and as the price has climbed back up this last year, so has IO.

Now, dealing with oil can be a tricky business, and you really have to find the perfect point to get in.

Over the last week, due to an increase in global production, the price of oil has gone back down very slightly (to around $66/ barrel).

This has also pulled the price of IO down, bringing it right to its moving average.

Now, this could present an excellent buying opportunity, but with oil being somewhat unpredictable at the moment, we need to keep our eyes on both crude oil prices and IO’s chart.

That way we can sue our knowledge to determine the perfect opening, just like the insiders.

It’s really amazing & wonderful opportunity