If you’re currently invested in the crypto market or have any intention of doing so in the future, then I advise you to proceed with caution.

If you’re currently invested in the crypto market or have any intention of doing so in the future, then I advise you to proceed with caution.

I think it’s fair to say that this past year has been one heck of a roller-coaster ride for Bitcoin and the other digital currencies surrounding it.

It seems as if the downs have been outweighing the ups; however, Bitcoin seems to be on track to reversing this trend, considering its recent 12% surge and all of the financial news circulating around imposed regulations for digital currency.

Although it’s impossible to predict, with 100% certainty, what direction the market will move in next, I’ve listed why Bitcoin appears to have a profitable future ahead of itself.

Allow me to explain…

Yes, cryptocurrencies in general are recognized for the volatility that they pose for investors, but this unpredictable market is the name of the game… Isn’t it?

These variations can obviously lead to dramatic gains OR losses, depending on where your investments stand in the market.

Let’s not forget that Bitcoin once only sold for a mere 30 cents a share, only to climb to its peak of $19,000 that it sat at this past December.

Although the extent of these fluctuations have died down and Bitcoin exists somewhere in the $6,000 range, it’s still not safe to say that crypto is a “stable” market. On the other hand, it is safe to say that good things seem to be underway.

As I mentioned, Bitcoin shares just increased by 12%!

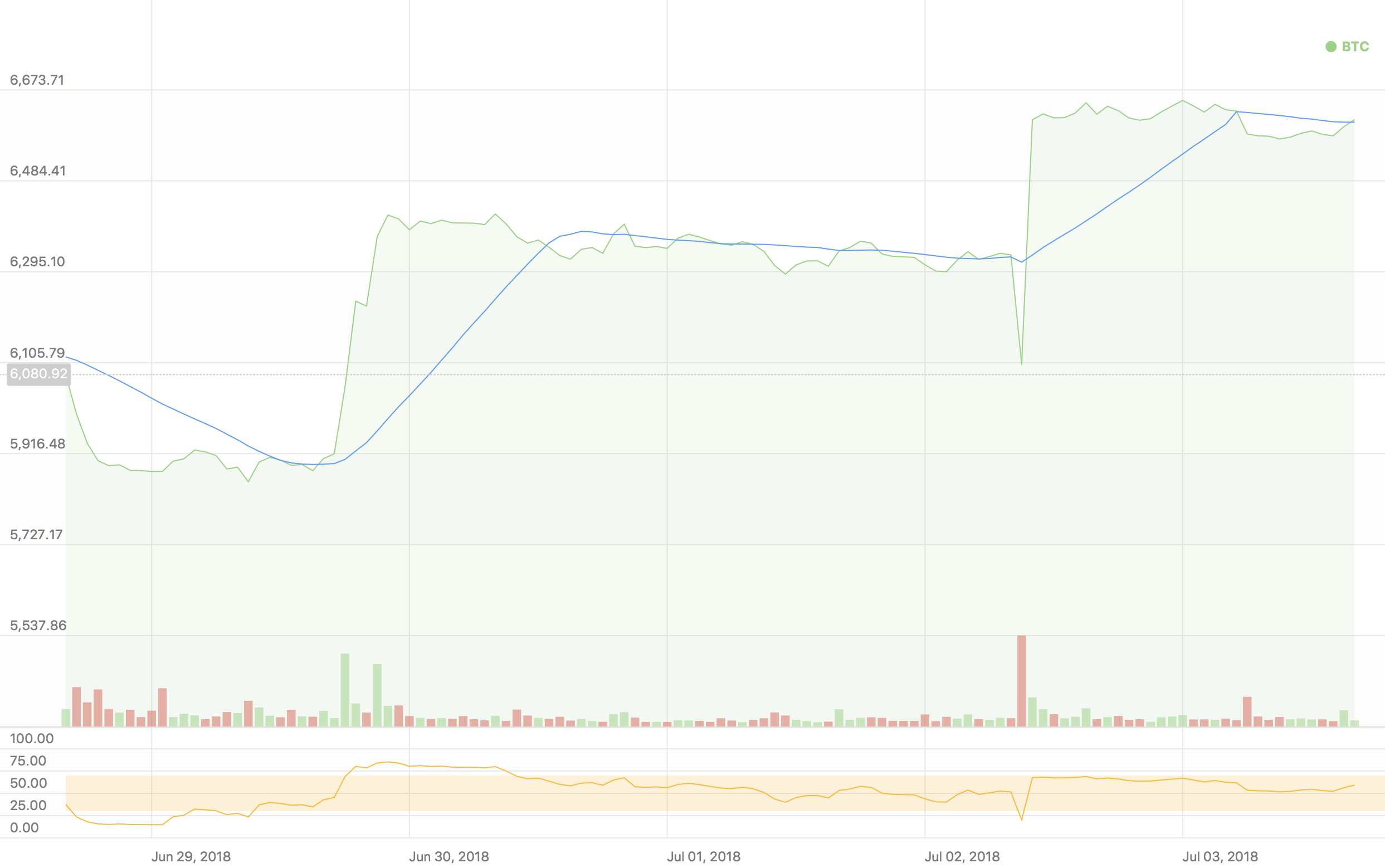

Let’s take a look at the chart below. Now, you don’t have to be an expert at technical chart analysis to realize that Bitcoin seems to maintaining an upward climb.

But, why?

In many cases, there is never a straightforward explanation for the behavior of the market; however, in this case, there at least seems to be a hint as to why.

This increase comes after 3 weeks of consistent declines, which pushed the coin to its lowest value in more than a year.

This climb is most likely a result of the threat of heightened regulations for the virtual currency around the world. For example, the Reserve Bank of India has now banned crypto from the country.

It’s no mystery why cryptocurrency shares shot up after the news got out. This governmental crackdown has motivated people to invest out of fear of losing crypto as we know it.

And it’s not just Bitcoin that seems to be reacting to the added pressure. Ripple, Ethereum and Litecoin rose as much as 15%.

So, who’s to say this trend won’t continue to climb upwards?

My goal isn’t to coax you into investing in crypto or adding any additional funds to your portfolio. I’m simply here to highlight the potential profits that lay ahead for Bitcoin and other competing cryptocurrencies.

I would like to join bitcoin but I will not have the money until the 23rd of july.