Forget whatever you think you know about insider trading.

Forget whatever you think you know about insider trading.

If high-up company execs, or really anyone with information that’s not public knowledge, trade behind the scenes, it’s illegal.

But I’m not talking about an overheard merger in a NYC elevator here. I’m talking about following the money.

I’ve got a deal for you, and for not the first time (and definitely not the last) the insiders made a mistake.

They’re trading the wrong way, and I’ll show you how their $13.3M sale in the past month means $118,360 for you.

Many Wall Street veterans will try to tell you that following the insider trades is a good way to make some serious cash.

What I like to say to that is: even a broken clock is right twice a day.

Yes, in the past we’ve discussed trades made in tandem with some big company insider movements.

But you should never stake your investing strategy on just one thing, especially not insider trading.

A famous author once said, “Insiders only buy a stock for one reason: if they think it’s going to go up. They’ll sell for anything.”

That alone should convince you not to obsess over the red sales on the insider platform.

A recent story broke about WeWork’s CEO, who allegedly sold millions of dollars-worth of shares amidst rumors that the company plans to go public later this year.

Media outlets took this to be a sign of bad faith in the company. In reality, it’s more likely he wanted some liquid cash to buy a new multi-million-dollar mansion (again).

As you can see, you can’t believe everything you read.

That being said, there are some instances where following the money can lead you to profits where you least expect.

Take Coupa Software Inc. (COUP) for example.

Between the Chief Financial Officer, Chief Revenue Officer, Chief Accounting Officer, and even Chief Executive Officer, 93,386 shares have been sold since July 1, amounting to $13,298,638.

That might make you think that the highest executives in the company believe bad times are ahead for COUP.

But our specialty system has COUP at an incredibly bullish standpoint in today’s market.

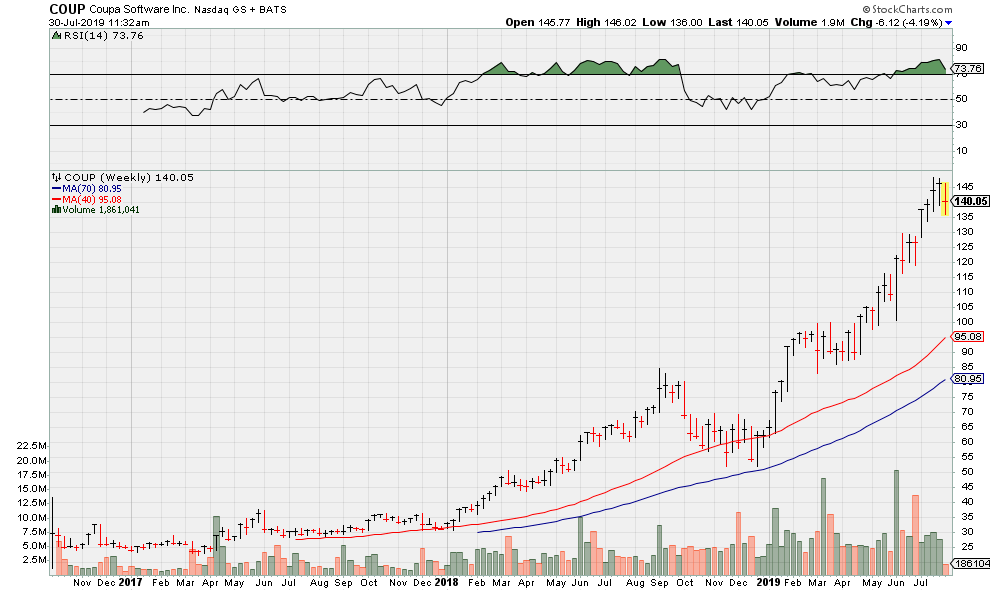

Take a look at the chart.

See that red line? If we had any doubts about where COUP’s stock price was going, it would be because it dipped below that long red line (the 40-week moving average).

We use that line as a kind of thermometer, to check the temperature or wellness of a stock. The line goes up as the price does.

As you can see, COUP is sitting almost 50 points higher than that line, and it’s pointed up.

We have no cause to believe that this beautiful up-trend since early 2018 is coming to a stop any time soon.

If you had bought into COUP in August 2017, you’d have $118,360 in your pockets to rub in the doubtful insiders’ faces.

That just goes to show that although these big-wigs have “chief” and “officer” in their title, they have no authority over the profits that are rightfully yours.