Wall Street heavyweights think they can throw their money around to make the market work for them.

Wall Street heavyweights think they can throw their money around to make the market work for them.

You’d think they’d realize that stocks don’t work that way.

Big-time CEOs and insiders trade with large sums of money to try to show faith in their company, or for darker reasons…

It’s time you made some money off of their schemes.

This president/CEO owes you the $17,140 profit from his company’s stock – and here’s how to get it.

I’m sure you’ve figured out by now that when lots of people buy a stock, it goes up.

That’s why when companies hit a bump in the road, their executives may purchase a massive amount of stock to show good faith in the company.

Financial experts have followed these kinds of purchases for years, and it’s been proven that there’s some merit to tracking insider trading.

But insiders buy and sell hundreds and even thousands of shares for other reasons.

The criminal definition of insider trading is when they make these trades with private information about the company or its stock that will influence its price.

The infamous Wall Street cases you see plastered all across the news are when these crooked insiders get caught in the act, and making money off of what the public doesn’t know.

Before you grab your phone to report each executive making headlines for buying shares, think about it. Some of these insiders merely want to see their company succeed.

But that doesn’t mean you can’t make money alongside them.

While financial moguls can drop six-figures on a good faith investment, I doubt you have that kind of cash sitting around (let alone not having a use for it).

Because we’ve caught onto their movements, I think it’s time these execs pay up for your hard work.

They can pump money into a stock all day long, but the average investor doesn’t see what’s happening until it’s too late.

A payout is exactly what you deserve for tracking their purchases up until now.

You know the saying, “No risk, no reward.”

Whether you believe it or not, this move will allow the insiders to take all the risk for you, and you get to collect your winnings once it’s paid off.

How this works is we find a company with a good track record. We keep an eye on their insiders, and if someone high-up makes a noteworthy purchase, we’re officially in the game.

After a little while, we see if their gamble pays off (i.e., the stock goes up).

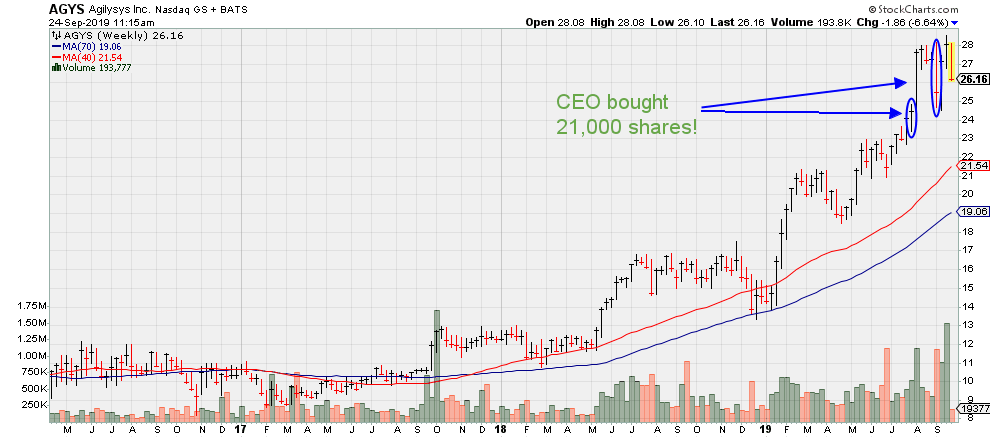

Take Agilysys Inc. for example.

With AGYS, we’ve got a company on the rise.

At the two blue circles, the President & CEO purchased 21,000 shares for $521,790!

Since then, we’ve seen a steady increase, not only following what we saw before in this chart that’s gone nowhere but up, but also in line with the insider’s investment.

AGYS investors have cashed out $17,140 before, and you don’t want to miss the next payout!

Let insiders play their games. If they slip up, it’s their conviction to deal with.

All you have to do is ride their coattails for profits like you’ve never seen before.

Good luck to me!!!

It’s really good…

Great! Show Me the Money!

Great let’s see if it works!!!

WSI TV on Demand

Long Term Trend Indicator

Recent Headlines

It’s this EASY to triple your money…

Your 4 Step Profit Plan

How to Make a Killing in a Market Crash

Hack Inflation with this Simple Trick

The next Stock Market Winning Lottery Ticket

How to Profit in a Bear Market (3 Steps)

How to Make a Killing in a Market Crash

Stepping stones to success

3 Simple Tricks FORCE the stock market to pay YOU

It’s this EASY to triple your money…

© WSI Associates, Inc. 1706 E. Semoran Blvd., Suite 114 Apopka, FL 32703. All Rights Reserved.

Partner With Us | Website Terms & Privacy Policy