I realize it might feel like all you hear about the stock market in 2018 is “volatility!” “uncertainty!” “instability!” and so on and so forth.

I realize it might feel like all you hear about the stock market in 2018 is “volatility!” “uncertainty!” “instability!” and so on and so forth.

While I imagine you’re tired of hearing the same old tired nouns, there are only so many different ways to say that 2018 has seen a rocky market climate, with trade war fears and political and economic uncertainties taking their toll on investors.

That may be our reality as investors in 2018, but it doesn’t mean for a second that we need to stop profiting!

Quite the opposite, in fact.

So many times this year when writing for Profit Hunter, I’ve stressed the importance of finding really solid stocks that don’t get completely pummeled by overall market action.

And again, I will be turning to stocks such as those in this edition of Profit Hunter, so you don’t have to waste time worrying over what other investors are doing and can instead continue making your biggest paydays of all time!

The company we’ll be taking a look at today is WNS (Holdings) Limited [ticker: WNS].

WNS is a business process management company based in India that, along with its subsidiaries, provides data, voice, analytical, and business transformation services worldwide.

WNS’ clients are primarily in industries such as insurance, travel and leisure, and diversified businesses including retail, manufacturing, consumer packaged goods, media and entertainment, and telecommunications.

Now, that’s all fascinating information, but why should you care about WNS?

As is so often the case with these stock picks, it comes down to the technical analysis and the charts.

WNS has been climbing beautifully since 2017, with even more impressive (and steep) gains in 2018.

Taking into consideration the general market conditions that have defined 2018, that is even more impressive.

Now as a financial analyst, I like to give you background information on the companies we track so you can have a holistic view, but in terms of where we put our money, what the companies do matters far less than how they perform.

Luckily for us, WNS has proven to be a very strong performer indeed.

It has beat earnings (by a LOT) the last three quarters and shown good holding despite market downturns.

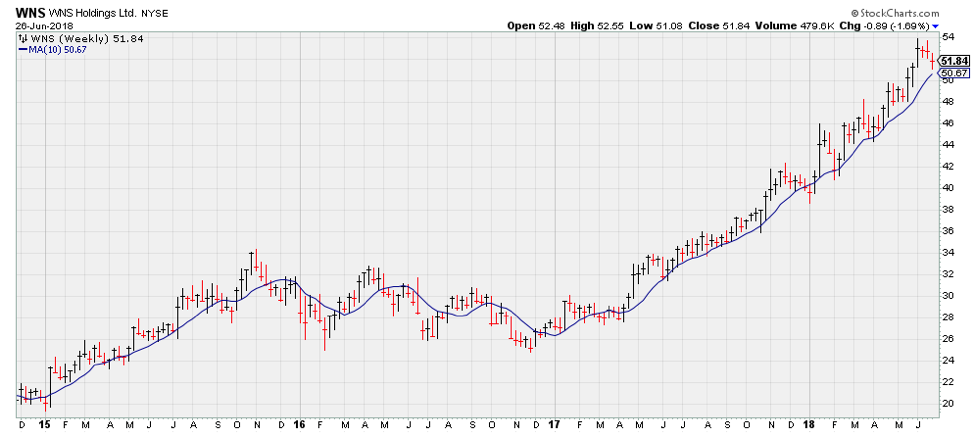

As I stated earlier, we always turn to the charts for our big winners, so let’s first take a look at the weekly chart for WNS.

You can see for yourself how the stock began climbing in 2017.

We see earlier gains as well in 2015, but then the stock seemed to struggle from 2016 to 2017.

Now, it’s not very surprising that WNS did well in 2017—2017 was a magical year for the stock market, practically anything you bought into immediately went up.

Its movement in 2018 is what is much more impressive, and therefore far more appealing to us as investors.

To get a better look at WNS’ action in 2018, let’s look at the daily chart.

Now WNS is not without its dips—we can see that it was affected by the downturn in February, as well as in April, but what we also see is WNS’ incredible recovery.

No matter how far down it dipped, it always bounced back up once it touched that 50-day moving average.

In the daily chart alone, we see WNS dip down and touch the 50-day SMA at the end of October, then again in January, then February, and April.

After each touch, it bounced back up, and over the last 5 months WNS has gained 36%.

That’s a big profit, especially considering that the majority of stocks have seen losses overall so far this year.

Hopefully it’s obvious why I’ve brought WNS to your attention at this time—as you can see on the daily chart, at the time of writing WNS was just about to hit that 50-day SMA again, which we know has historically been a great buying opportunity, allowing us to get in at a lower price right before the stock bounces back up.

So, keep your eyes on WNS and see if history will repeat itself—it usually does when it comes to the stock market.