We all know 2018 has already been a crazy year for the stock market.

We all know 2018 has already been a crazy year for the stock market.

While many investors have been frightened off by the volatility, those in the know are raking in more money than ever before!

I want to make sure that you’re one of those making money no matter what’s happening, and I’ve found the pick to do just that.

So far, the only ones who’ve been able to profit off this stock have been the insiders, but I’m hoping you can join their profit-ranks sooner rather than later!

It’s clear when certain industries are being hit particularly hard in the stock market.

For instance, we’re all aware of the trouble tech has had in the past several weeks, thanks to fears of data leaking and privacy concerns.

Even before tech hit their hurdles, retail had been getting beaten from seemingly all sides as e-commerce becomes more and more threatening to traditional retail companies.

Already 2018 has seen the closing of 24 major retailers, and more are expected to follow suit.

With all of that going on, it can be hard to find industries that are actually doing well and holding up against things like trade war concerns and privacy issues.

One such industry is financial services. The U. S. economy has been doing well, to an almost unprecedented extent.

Innovations we’ve seen in technology and communications have also contributed to strength in the finance industry as new advancements have allowed the banking world to develop like never before.

PayPal (PYPL) has always been an innovator in the financial services industry.

Since its founding in 1998, PYPL has changed the credit world as we know it as the company that first brought digital payments to the world.

E-commerce has fueled PYPL (and vice versa) as nearly every online retailer accepts PYPL as a form of payment, and even accepts it over credit and debit cards frequently.

The insiders have been making monster profits off of PYPL for years, but those profits have shot up recently (spurred by the e-commerce revolution).

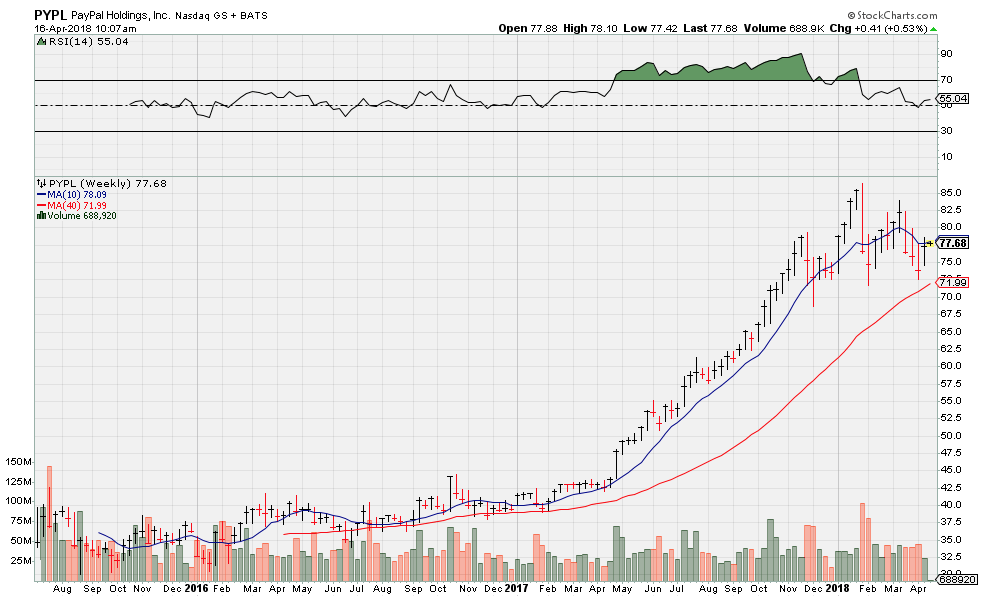

In less than a year, from January 2017 to November 2017, PYPL shot up 100%!

The insiders managed to double their money in less than a year.

If that still seems hard to believe, I invite you to take a look at the weekly chart for PYPL.

Now clearly, that growth from 2017 on is outstanding.

You may be thinking that it’s unlikely that we’ll see that kind of growth from PYPL again.

While I can understand your concern, I have information that only the industry insiders have that I think will convince you that that kind of growth is likely to repeat, and even exceed what has happened historically.

Obviously PYPL has been an innovator, processing payments online before anyone could begin to imagine why that might be important.

Now, PYPL is innovating again and they are going into new territory for themselves.

PYPL has been secretly testing their new services with a few select insiders, and will now be rolling it out to customers worldwide in the first half of this year.

PYPL will be expanding into more traditional banking services.

Those services will include direct deposit, debit cards, and mobile check processing.

You may be wondering why PYPL would be interested in becoming involved in more traditional banking services, since they’ve clearly done very well with what they’ve been doing.

However, thanks to PYPL’s solely online presence, they’re able to reach far more customers than most traditional banks.

PYPL is also offering a more economic option for banking customers, since they won’t be charging any annual fees or requiring a minimum deposit.

In addition to serving existing banking customers in an increasingly digital world, PYPL is also hoping that their new banking services will provide service for individuals in “banking deserts” and those who’ve never had access to bank accounts before.

PYPL is once again making their own path in the finance world and will be helping individuals who’ve never had access to banking, as well as offering existing banking customers a more efficient and streamlined banking experience.

If we thought we’d seen growth from PYPL in 2017, just imagine how that growth will skyrocket now as they launch their all-new banking services!

Don’t let the insiders be the only ones who get to profit off of this monster innovator—ensure you’re doubling your money just like them (and sooner rather than later)!