With the U.S. in the middle of a financial war over trade and currency, there are bound to be casualties.

With the U.S. in the middle of a financial war over trade and currency, there are bound to be casualties.

Unfortunately, those casualties have spread to encompass even some of the strongest stocks as the market saw its worst week in over a decade this month.

The market has been in chaos for weeks now, but this financial downturn has the insiders and the trading pros running for cover swifter than ever.

But here’s the thing—even with the market tanking, there are diamonds in the rough.

I’ve been scouring the markets for a safe bet, and I’ve found just the thing with a company that is seasoned, diverse, and ready for the turbulent times ahead.

In fact, even as the S&P falls at a huge rate of 1% a week, this stock is rising by almost 4% a week, and handed investors 122% gains in the last year alone!

You may be wondering if this company has a secret to success, and in fact it does.

You see, there’s a reason why ‘diversified’ is the magic word in the financial world. If you are diversified, you have a strong enough foundation to withstand any storm—even one as chaotic as our current trade situation.

The company I’m going to share with you is about as diversified as it can get, with its hands in industries as seemingly unrelated as soda and space travel.

Sounds…eclectic right?

Before you judge though, I think you’ll be pleasantly surprised by what an institution this company is.

If you look up the logo, it will probably already be familiar to you. In fact, you probably have several products with the company name on it in your house without even knowing it!

The company I’m talking about, of course, is Ball Corporation (BLL).

Founded in 1880, this company has been sweeping the stage of the stock exchange since the 1970’s.

The company originally specified in canning and was the leading producer of glass jars for the first several decades of business (if the name isn’t ringing a bell yet, go take a look at one of the mason jars in your kitchen for that trademark cursive “Ball” logo!).

Now that you recognize that classic mason jar logo, you’re probably wondering more than ever how a company could be involved in canning and aerospace at the same time. It seems too separate to be successful, right?

Wrong!

The diversification of the company actually happened fairly naturally, and just proves how versatile Ball Corp. has the potential to be—a trait that is absolutely essential for long term company success.

Around WWII, demand for jars decreased and the need for war support led to the company shifting to produce shells and machine parts for the military.

After the war, the continued decline in jar demands and a newfound industry under the company’s wing led Ball to continue down the avenue of machine and military production, eventually landing in the industry of aerospace systems.

In the 1950s, Ball became a partner of NASAs and launched several successful spacecraft, including the OSO-1 spacecraft in 1959.

Today, Ball is at the forefront of innovative avionic and aerospace system engineering and production, while still maintaining it’s original sector of canning—only with a twist.

And that twist has caused the company to increase revenue at an unprecedented rate. Free cash flow for the company is projected to reach over $1 billion this year, and the revenue for the aerospace sector of the business amounted contracts worth $4.8 billion so far this year.

Plus, in the canning industry, it surpassed average growth exponentially with 78% gains this year alone while the rest of the sector lags behind at just 51%.

How is this possible?

Because, like I said, Ball is versatile.

When traditional glass jars declined in popularity, Ball switched gears and has since dived headfirst into the production of metal cans. Today, the company produces the packaging for dozens of companies in industries like beverage, food, paint, aerosol, and even automotive packaging.

If you look up Ball on social media, you’ll probably recognize some of the logos on the cans they supply. Coca cola, San Pellegrino, Dale’s Pale Ale, Corona, Perrier, and La Croix are just a few of the beverage industry names that are in business with Ball Corporation.

Are you convinced that this stock pick is diverse enough to withstand the current market?

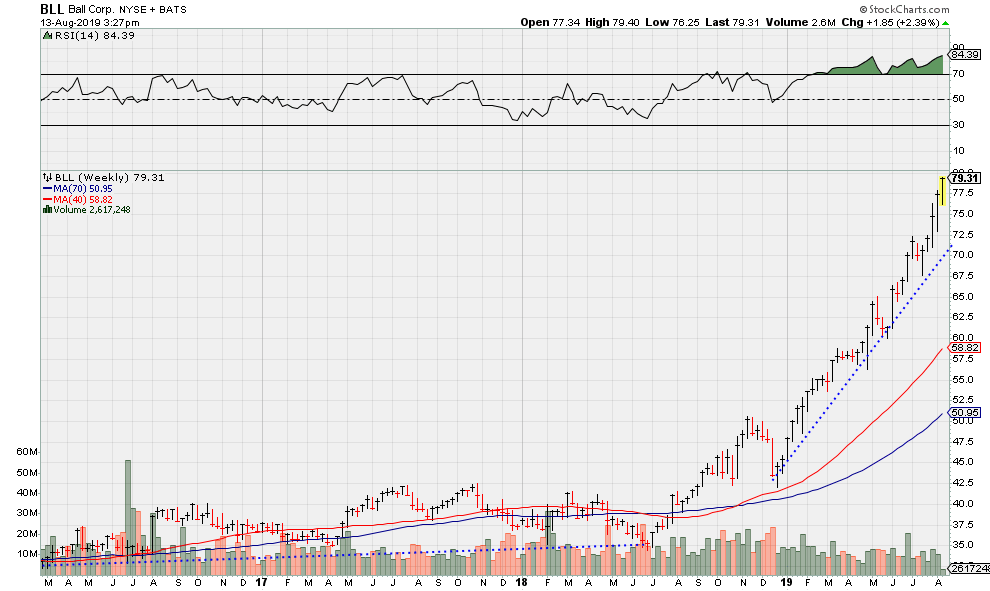

If not, maybe the chart will convince you.

As you can see, the company’s price has been holding steady for the past several years, before suddenly taking off starting in June of 2018.

Ironically, or perhaps thanks to the clever forethought of Ball, the stock started to surge right when the rest of the market started to teeter.

We can attribute the strength of Ball Corp. in such an unsteady climate to the ongoing need for defense and aerospace advancement as well as the increased demand for metal canning over plastic or glass.

This demand is thanks to a lot of things, from production and transportation costs to recyclability and ease of storage, and Ball has taken advantage of it.

The company is the world’s leading producer of recyclable aluminum packaging, and this year announced further investment into cost effective and recyclable packaging, which has a hand in the wonderful performance of the stock.

For investors who bought in last June, Ball handed back $42,919 for just 1000 shares!

It’s not to late for you to make YOUR fortune on this sustainable goldmine!