Well, we’ve just rounded out the worst quarter for the stock market since 2011. The entire sentiment surrounding Wall Street has changed for the public seemingly in the blink of an eye.

Well, we’ve just rounded out the worst quarter for the stock market since 2011. The entire sentiment surrounding Wall Street has changed for the public seemingly in the blink of an eye.

But there’s no sense dwelling in the past, no matter how immediate. Instead, we have to focus on the “now” if we’re going to hunt down profits.

That’s why you should be very interested in what could very well be the intermediate bottom for the stock market right now, and how you could make thousands because of it…

Let’s be perfectly clear – we’re in a transitional stage here. And that means volatility, especially for the month of October, which is a traditionally volatile month.

That’s why we need markers to help us. Like a mountain climber looking for handholds to grasp onto, we need to identify (at least temporary) benchmarks that will guide us towards profitable opportunities.

And it all starts with the overall market.

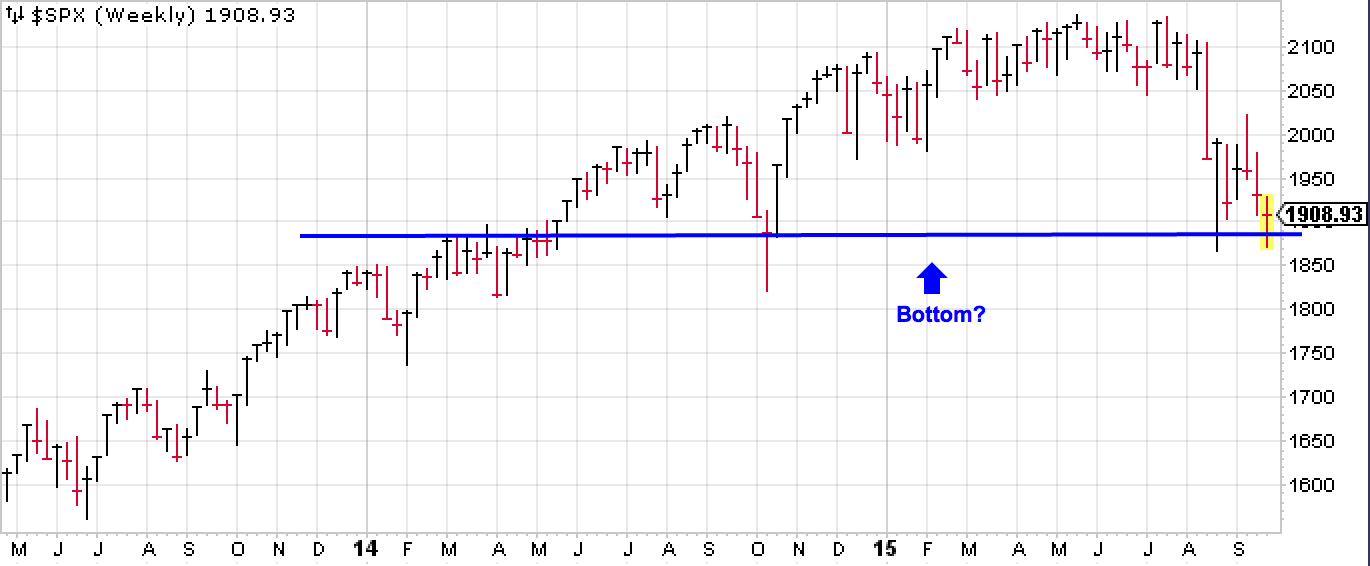

I like to use the S&P 500 (SPX) index as my representative for the market, as I feel it offers the most balanced and realistic representation of the market as a whole. And there’s a strong chance that we could now be bouncing off the SPX’s intermediate bottom.

I say intermediate because I don’t think this is a long-term bottom due to the fact that more and more indicators are screaming “BEAR”, but a “for now” sort of bottom can help us snag profits right now.

Check out this chart of the SPX from stockcharts.com:

That blue line I’ve drawn there is a strong level of support. This means that, going back as far as early 2014, there are several points where the SPX bounced off of that level.

That support may not be enough to keep the market from plummeting as a bear market, but it could very well offer some heavy resistance as the market tries to dip right now.

The best part is that, if this isn’t the market bottom for now, it should become clear right away. If the SPX can close below that blue line, it’s off.

But while this still appears to be the bottom, we can expect temporary bounces upward when the SPX nears that line.

Easy profits, anyone?

My advice for you if you decide to adopt this strategy is to closely monitor your trade and the SPX when your position is open. In this type of market, caution is wise.