For the most part, investors, such as yourself, tend to take in the most profits by trading stocks that go UP in price.

For the most part, investors, such as yourself, tend to take in the most profits by trading stocks that go UP in price.

“Buy low and sell high”… we’ve all heard this trading tip before and I’m sure at this point it’s starting to feel like beating a dead horse.

If you’ve been regularly staying up to date with the WSI TV content, then you know firsthand that there have been plenty of gains in the market to go around and keep yourself occupied with.

But perhaps you’re growing bored with the whole buy low, sell high process or are simply looking to broaden your horizons as an investor.

Whatever the case may be, I’m here to tell you that you ARE NOT limited to this formula and there are other trade tactics to utilize when hunting for profits.

Believe it or not, there is just as much viability in buying high and selling low. Allow me to explain…

The secret to buying high and selling low is hidden within a common investment practice known as options trading.

But why in the world would you want to buy high and sell low? After all, wouldn’t that mean you would be left in the red after a trade was packaged up and shipped off?

For traditional trading, the answer is YES; however, when it comes to options, it’s a different breed altogether.

Rather than closing out a trade and claiming the gains from a stock that exceeded the cost you originally bought it for, options trades operate off betting if a particular stock will go up or down by an agreed upon date.

In the world of options trading, betting that a stock will increase is referred to as a call and betting that it will decrease is known as a put.

It’s gambling in a sense, but isn’t all trading to a certain degree?

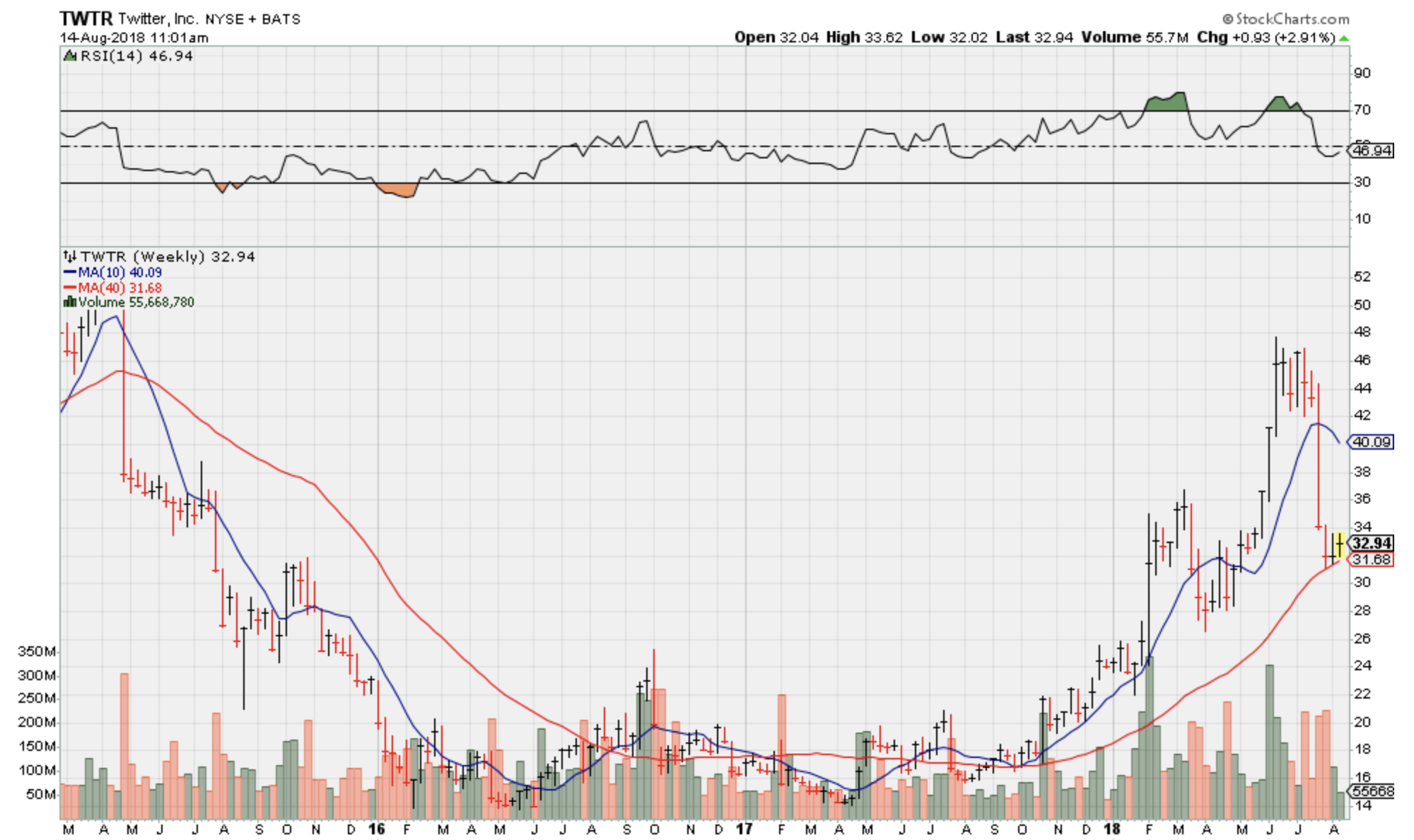

Take a look at the weekly chart for Twitter (TWTR) below.

Judging by Twitter’s recent dip in value, this chart spells out bad news for traditional trading and call options; however, it’s quite the opposite for put options…

Now, obviously you wouldn’t be 100% certain that Twitter would take the plummet it did, but for the sake of example, let’s pretend that you can’t see past July.

For whatever reason, you believe that Twitter shares are heading for a decline. So, you look at the available options contracts and place a put for the beginning of July that predicts Twitter’s price will drop to $40 (we call this the strike price) or lower in one month’s time.

At the beginning of July, Twitter shares are valued at $46.75 and by the start of August they happen to fall down to $31.46. Can you guess what happens next?

That’s right! You’ve just managed to get paid by simply predicting that Twitter’s stock price would drop to $40 or below. It’s that easy!

To make matters even more appealing, options are typically sold by 100 shares per contract. That means that whatever revenue you reel in by the expiration date of the contract gets multiplied by 100!

In other words, if an options contract that you initially purchased for $10 decreases to $7 it would leave you with $3 in returns, which would equal out to $300 worth of profits!

As an investor, you’re not only restricted to the gains that come from healthy stocks. Even if the market is trending downward, you can still make money from the losses by trading via put options.