There’s more than one way to track company shares and gauge the current state of the stock market.

There’s more than one way to track company shares and gauge the current state of the stock market.

But nothing checks up on the health of your investments quite like copper…

Here’s how this base metal managed to earn the title of “Dr. Copper” and why it’s so heavily relied on as an indicator for the global economy.

For starters, copper is one of the most versatile commodities on Wall Street.

The metal has such a widespread application that it’s used in almost every sector of the market.

Just to give you an idea, 65% of copper production goes to electrical companies, 25% is used by industrial manufacturers and 10% is spread out to everything else.

Because copper has essentially tapped into every nook and cranny that’s wroth investing in, it can be used to predict certain turning points in the economy.

For example, rising copper prices not only suggests that there’s a strong demand for it on the horizon, but it also hints towards a thriving market.

That said, it’s no mystery how the “Dr. Copper” nickname came to be. After all, it is used to gauge economic health.

Copper’s role isn’t only limited to the American economy though…

Studies show that there’s a strong correlation between copper’s stock value and world trade as well as prices of oil and gold.

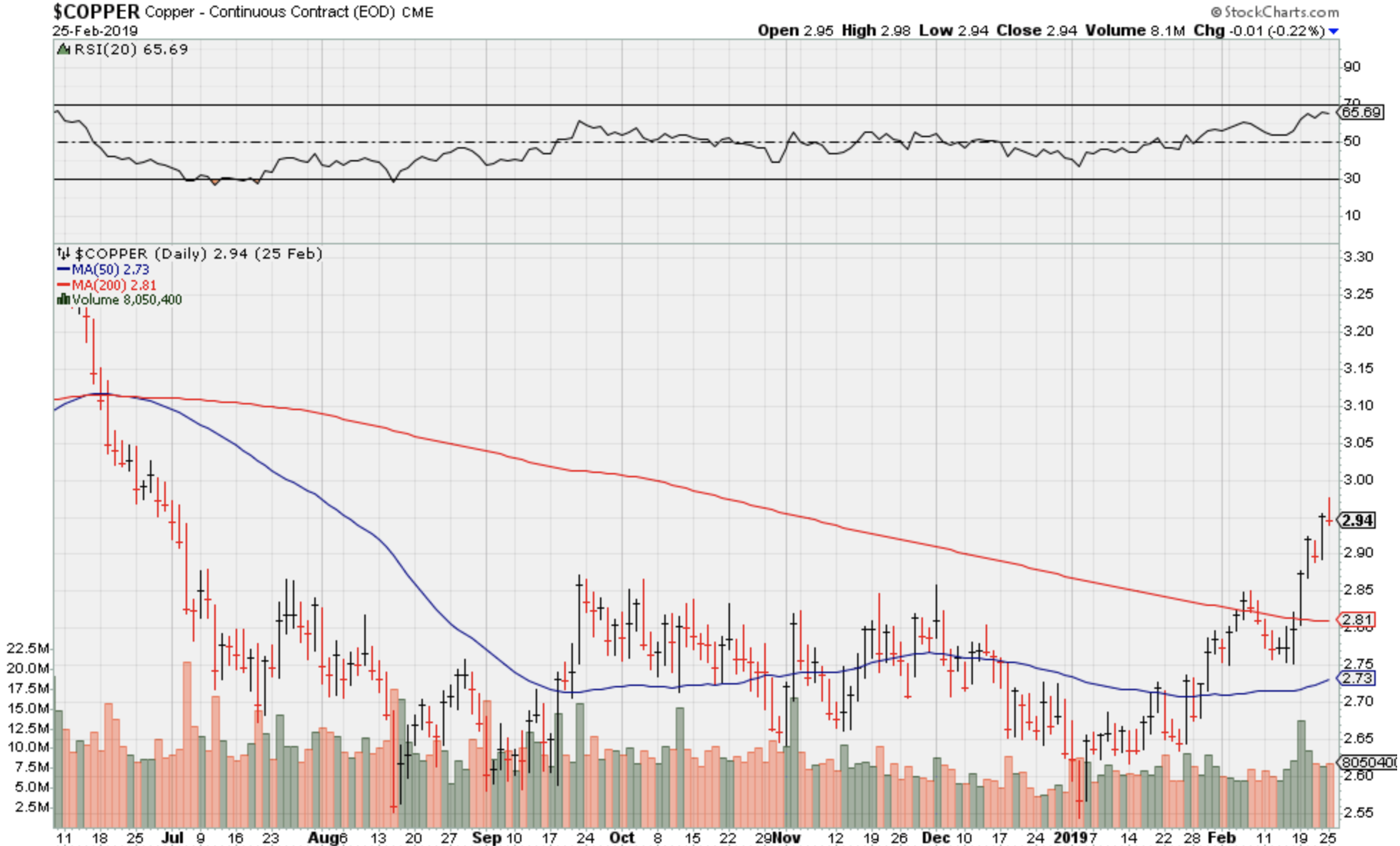

If you look at the chart below, you’ll notice that shares have started to trend back up ever since the start of 2019.

In other words, the market as we know it is now beginning to head in the right direction!

Although copper is considered a reliable indicator, it shouldn’t be the only resource that you turn to when analyzing your open or potential positions.

Factors, such as the recent tariffs the U.S. imposed on China, can sometimes artificially inflate the price.

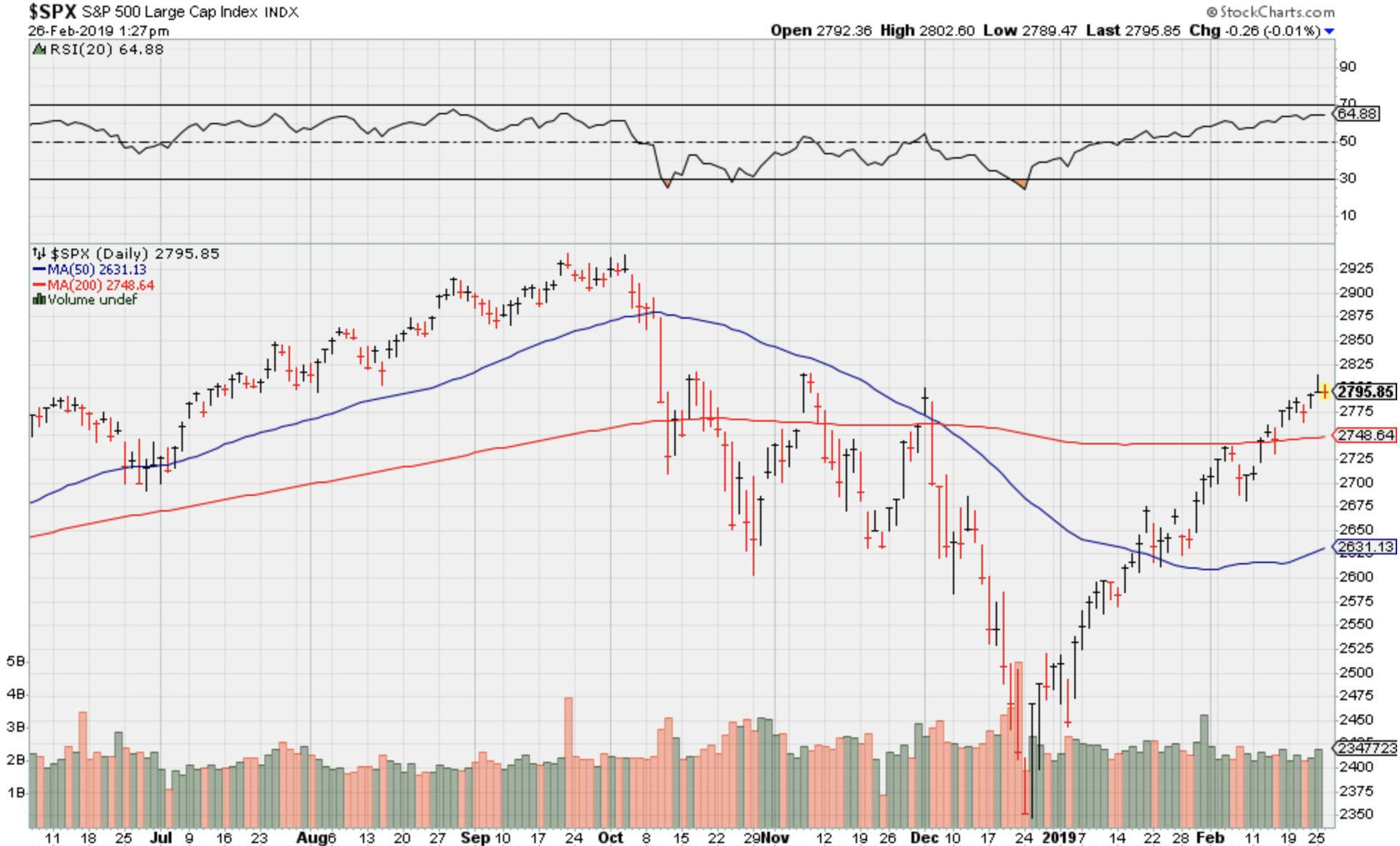

So you always want to have another tool like the S&P 500 to turn to. But judging by the current status of this particular index, we seem to be in the clear.

As you can see, both indicators somewhat reflect the other and I think it’s fair to say that a bull run is about to be underway if it isn’t already.

There’s a reason why market and commodity analysts turn to “Dr. Copper” when they’re trying to get an idea of where shares are heading next.

So, why not follow in their lead and add this base metal to your toolbelt as a way to make the most out of Wall Street?