We always talk about insider trading, but how do you know when a good deal falls into your lap?

We always talk about insider trading, but how do you know when a good deal falls into your lap?

Executives and insiders buying and selling shares in their company may not be doing so because the company is doing well.

There’s a trick to telling the potential gold mines from the bear traps.

Let me show you how we sift through the thousands of insider trades a day to find ones that make you money.

Then you can claim your cut of this $5 million exec sale.

Company big-shots often have those important letters in their title: C and O.

Whether it’s a CMO, CFO, or even a CEO, the chief officers in any company undoubtedly have private information about how that company is doing.

That’s why we pay such close attention to their movements in and out of the stock.

It’s especially difficult to turn a blind eye when one of these executives makes 3 identical sales transactions in the span of 3 months.

The Chief Financial Officer of Alteryx, Inc. sold 46,267 shares 3 separate times: in July, August, and September.

After factoring in the fluctuating stock price, those sales equated to $4,985,489.

That’s a hair shy of $5 million for everyone who’s keeping track.

I don’t know about you, but I’m wondering what it is this guy knows that everybody else doesn’t.

Whether CFO Kevin Rubin sees bad times ahead for Alteryx or just needed some cash for a new yacht, we’ll never know.

But what we do know is how to tell if this sale means anything to us.

Perhaps you’ll recall a couple months ago when the famous Bernie Madoff whistleblower tried to take out General Electric (GE) at the knees.

Reminiscent of his old scheme, he released a report alleging wonky accounting practices at GE, which in turn made their multi-billion-dollar valuation look very shaky.

Come to find out, he was paid by a firm shorting GE stock (AKA betting on it to go down), and experts believe that’s why he leveled these accusations.

Story time is over, but what you should know about that debacle is the CEO of GE bought a ridiculous number of shares after that report went out to prove his belief in the soundness of the company.

That just goes to show that insiders will buy and sell company stock for anything.

We can’t pretend to know what motivates their decisions, but we can try to profit off of them when it benefits us.

That’s why I’m going to show you how I sort the fool’s gold from the real deal.

The difference between a good stock and a bad stock isn’t one thing we can just point to.

But we can pinpoint certain differences that help YOU make money.

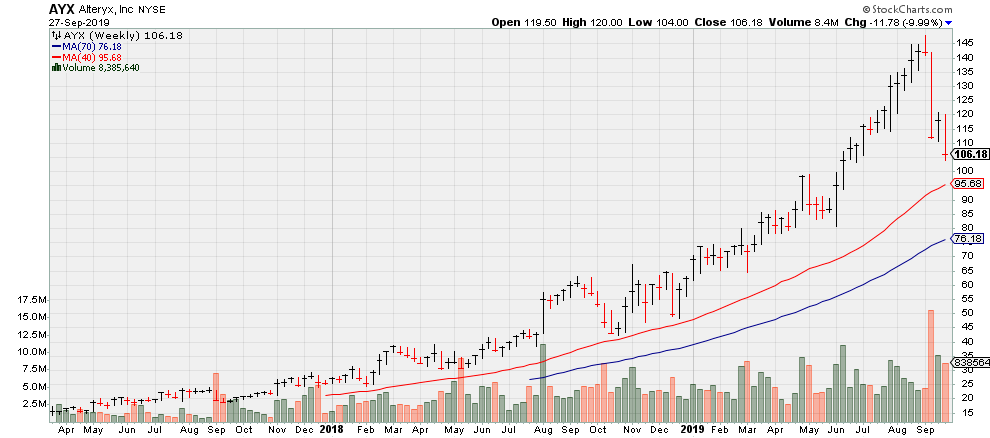

Take a look at the Alteryx chart, under the ticker AYX.

You see how the stock price forms a curve upwards? That’s important, but it’s not what means you’re going to make money.

What you need is a support system, and lucky for you, AYX has the one we need.

See that red line? That’s the 40-week moving average.

I’ll save you all the mathematical details explaining what that is; you just have to know that it tracks the stock price over a long period of time.

That’s important because you can see the AYX price points never drop below that line.

Essentially, that means we can rely on it as support for the stock price.

And we’ve just seen a slight dip bringing it closer to the red line.

You may think that’s a bad thing, but trust me, it’ll bounce back off that red line in no time and you’ll make MORE money because you bought at a lower price.

In 2 years’ time, AYX returned 650%, or a $12,288 profit if you’re keeping score.

While $5M is definitely preferable, twelve thousand dollars is a healthy chunk of money for doing absolutely nothing but riding on the coattails of insider trades.

Thank you very much

Elsie L Smith

thanks for help.

Hi

Thank you for your time and help.

Thank you, thank you, thank you very much.

WSI TV on Demand

Long Term Trend Indicator

Recent Headlines

These scammers could be taking your money…

How This digital gold makes YOU $83k a year

It’s this EASY to triple your money…

Your 4 Step Profit Plan

How to Make a Killing in a Market Crash

Hack Inflation with this Simple Trick

The next Stock Market Winning Lottery Ticket

How to Profit in a Bear Market (3 Steps)

How to Make a Killing in a Market Crash

Stepping stones to success

© WSI Associates, Inc. 1706 E. Semoran Blvd., Suite 114 Apopka, FL 32703. All Rights Reserved.

Partner With Us | Website Terms & Privacy Policy