When the global economy is booming, this play offers up hefty payouts. And right now, the global economy is on fire.

When the global economy is booming, this play offers up hefty payouts. And right now, the global economy is on fire.

So, now is the time to capitalize on this opportunity as the world gobbles up the supply.

Investors have been hands off this since 2014, but recent signs all point to BIG gains for the savvy investor.

If you don’t already know… I’m talking about OIL.

The bottom line is, as of now, oil is back. And there’s a ton of money to be made.

But first, let’s review why oil had such a bad run and whether it made sense.

First of all, a lot of new oil hit the market from increased production of U.S. oil shale. And as you know, more oil means cheaper prices.

Then, add on top of that increased production from Russia and Saudi Arabia.

While all this made sense, an unexpected force caused an even more dramatic drop in oil prices. This was the unpredicted economic weakness in Europe, Japan, and China.

The truth is though, the markets overreacted.

You see, when the oil market hit a 14-year low in 2016 global demand was actually on the rise.

Which brings us to this point… according to Morgan Stanley world oil markets were undersupplied by half a million barrels of oil a day in 2017 and 2018 is expected to again run a deficit.

This growing deficit, along with a booming global economy make oil an attractive moneymaker for today’s savvy investor.

So, you might ask how should I play this industry on the rebound?

Well, there’s a few ways to capitalize on the OIL comeback.

First you have the exchange-traded fund XLE.

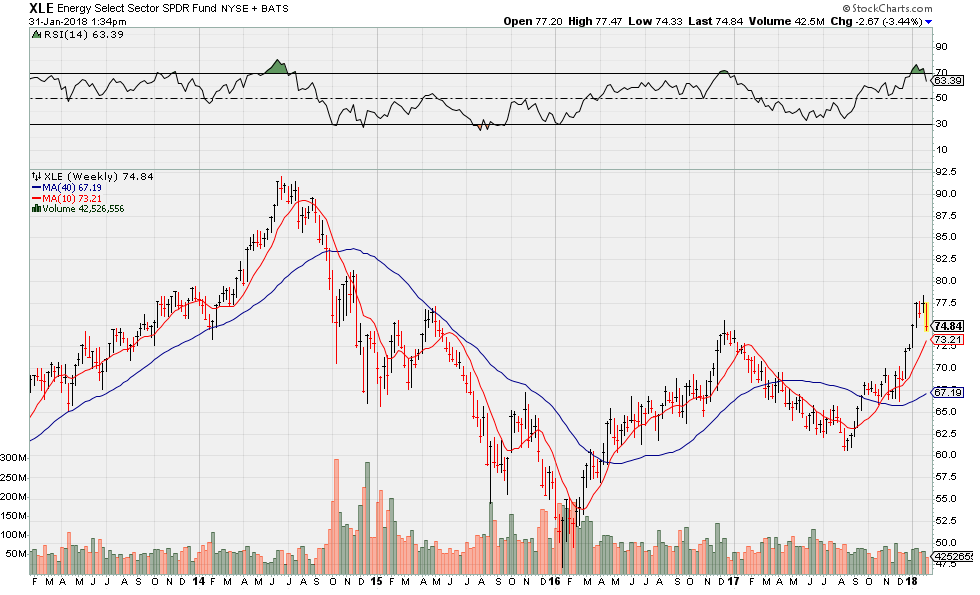

Here’s the look at its chart.

Now the chart shows a recent price jump and has signs of more gains to come, I’d hold of until it bounces off its 40-week moving average. This will allow you to capitalize on the biggest potential gains.

There’s another way to play oil’s current surge that can increase your gains by 300%.

I’m talking about using VelocityShares 3x Long Crude Oil ETN, ticker symbol UWT.

This is the leveraged version United States Oil (USO).

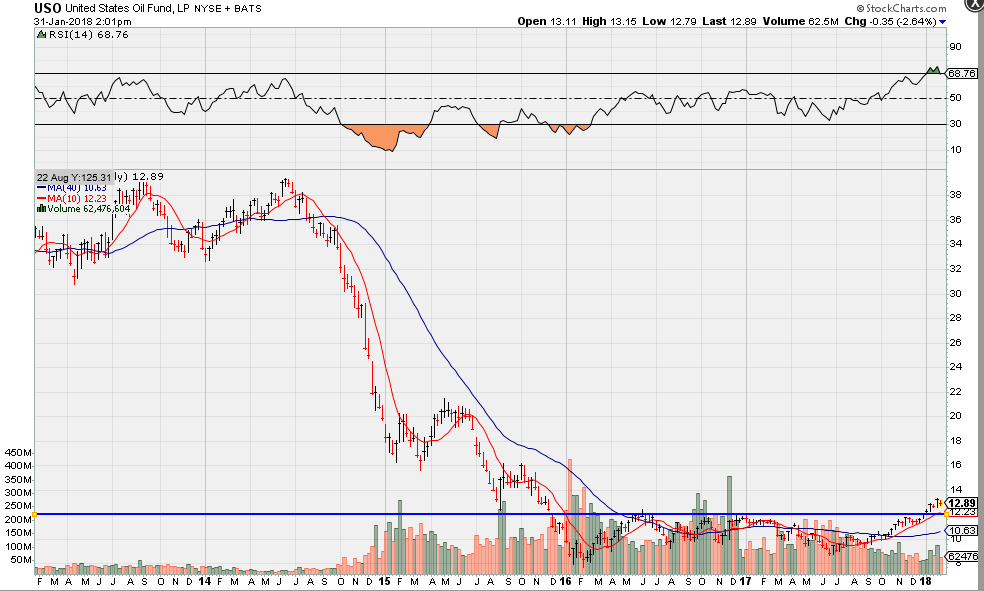

Now the key here to capitalize on the leveraged ETF is to follow the underlying commodity, which in this case is USO.

As you can see from the chart below, the blue line represents a line of resistance. But you’ll see that the price has broken that line of resistance and become a line of support.

This is a good indicator that there’s a strong likelihood USO will continue to climb.

Now’s the time to enjoy the explosive profits oil is bringing to the table.