Once upon a time, the dollar was backed by gold.

Once upon a time, the dollar was backed by gold.

It wasn’t until the early 1970’s when President Nixon took the U.S. off the gold standard and announced the country’s currency would no longer be convertible into this precious metal.

Because of this move to fiat money, the dollar and gold no longer go hand-in-hand. In fact, they now work opposite of one another.

Here’s how to make sense of this relationship between gold and the dollar and how the two can be used to easily predict profits in the market.

You’re probably wondering what it means for gold and the dollar to work inversely of each other.

It’s pretty simple actually… as the U.S. currency increases, the price of gold is forced downward.

But what exactly causes this bearish effect?

The fact that rising interest rates pump up the dollar and make bonds and other fixed-income investments more attractive explains enough in itself.

As more money flows into these higher-yielding trades it consequently drains out of gold, which offers no yield at all.

Make sense?

It’s the same reason why investors consider transferring funds into gold whenever the stock market declines.

Just to put things into perspective, gold prices soared more than 150% during 1973 and 1974, due to the S&P 500 losing more than 40% of its value.

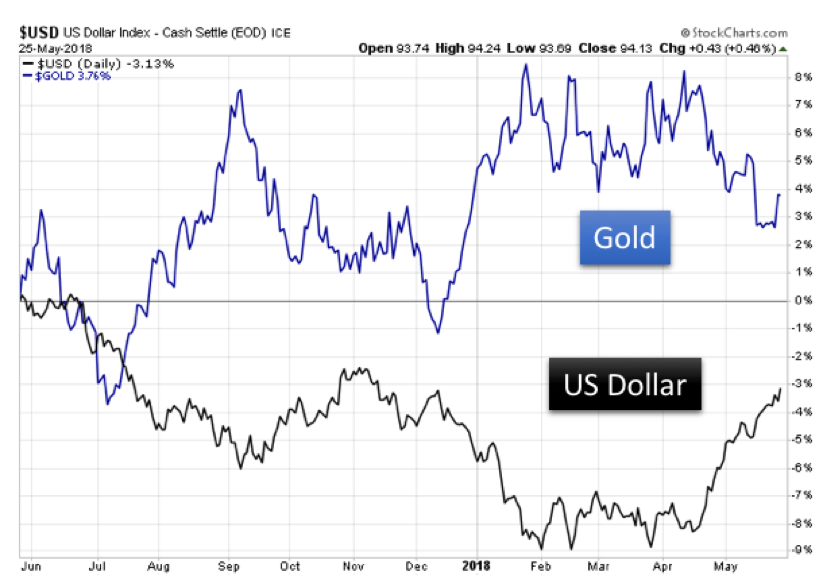

The chart below from last year will give you a better idea of what I’m talking about…

As you can see, there’s a clear push-pull relationship between gold and the U.S. dollar. Whenever one starts to trend up, the other dives down and vice versa…

Having a solid understanding of this knowledge alone can play a direct role in the investments you choose to take on.

If a recession is underway, then it may be a good call to transfer your shares over to gold or play it safe and go to cash.

On the other hand, it’s likely that rising U.S. currency values will result in a price drop in gold, so plan accordingly.

Obviously there are other factors that feed into this, but that’s the gist of it.

Don’t take a shot in the dark when it comes to Wall Street. Conduct each and every one of your trades with an educated approach so you can see what lays ahead.

Sure, there’s always a bit of risk that comes along with investing in stocks, but expanding your knowledge on all the various ins and outs of investing will help you hit the bullseye on the profits you’re aiming for.