Imagine being able to turn a profit of $932 in two weeks. There’d be no hard work, no manual labor, and no sales pitches—you’d simply be exploiting the stock market.

Imagine being able to turn a profit of $932 in two weeks. There’d be no hard work, no manual labor, and no sales pitches—you’d simply be exploiting the stock market.

All you’d have to do is click a few buttons, and click a few more two weeks later. Your $932 profit would be in your account, and you’d be able to do with it as you please.

The stock market is full of signs and loopholes, and this one has come at the perfect time. Take a look.

There’s a lot of talk about earnings lately, and it’s for good reason. February is a big month for fourth quarter earnings reports, which also means end of year sales.

The yearly growth of a company is an extremely important aspect to stock market investors and traders because it provides a full year of information that can be used going forward.

The main ingredient that drives stock market prices is speculation. If a company is projected to perform well for a certain year, then its stock price will reflect that; if the company falls short of its goals, the stock will take a heavy hit.

Many people avoid trading stocks during earnings season because they’re afraid of the impact the reports could have.

But earnings reports can be an important trading tool, both before and after their release.

I only trade stocks before their earnings reports if they show me significant signs, like the one I mentioned earlier: $932 in two weeks.

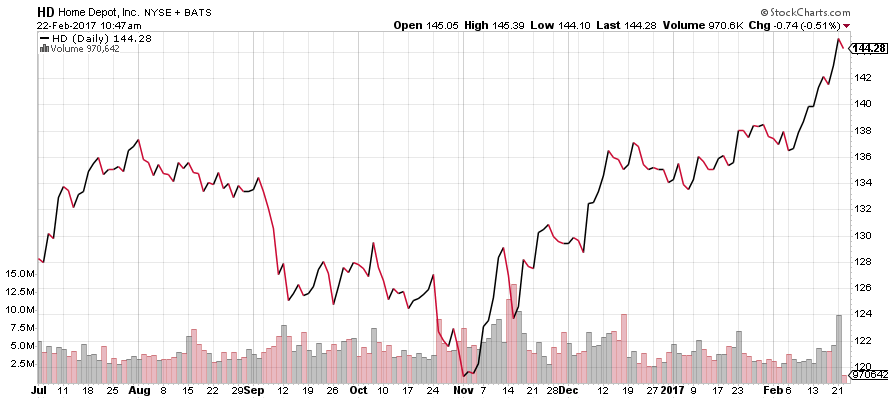

Those numbers, specifically, come from Home Depot (HD). As you can see in the chart below, if you would’ve bought 100 shares of HD on February 7th and sold them two weeks later on February 21st, you would’ve made that $932 profit from a single trade.

A significant aspect of this gain is the fact that HD reported its earnings on February 21st.

Knowing that HD was scheduled to report its earnings on the 21st, there was one factor that made me bullish on it: its chart’s uncanny similarities to the Dow Jones ($INDU) chart, especially post-election.

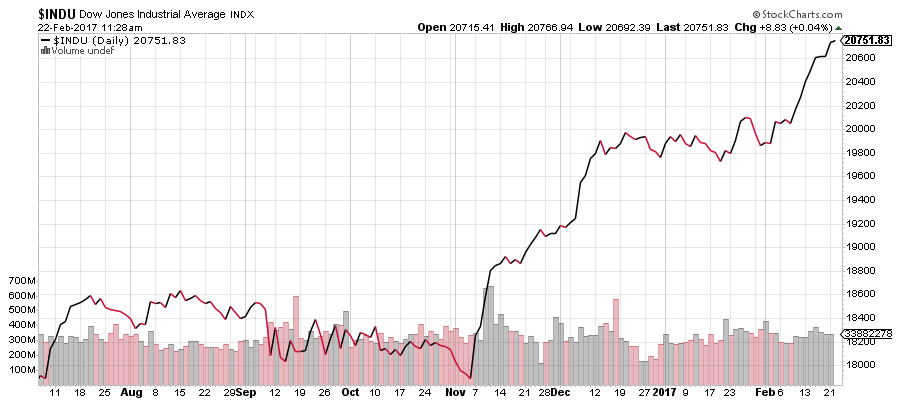

Take a look at the Dow Jones chart below, and notice the similar movements between the Dow Jones and HD after November 7th.

With this in mind, I came to one conclusion: If the Dow Jones continues its upward momentum, chances are HD will also.

So even though this trade has already passed, your two-week $932 profit has not gone with it.

Let me explain. The reason why the chart of HD is so similar to the Dow Jones’ chart is because HD is 1 of 30 stocks that the Dow measures.

There are 2 stocks out of the Dow 30 that’ve yet to report earnings, and with this newfound information, you’ll be able to track them and capitalize on your two-week $932 profit.

Those are JP Morgan (JPM), which reports on April 13th, and Nike (NKE), which reports on March 28th.

And even if these two remaining Dow stocks don’t look particularly profitable as they approach their respective earnings dates, the same similarities will form during second quarter earnings which will fall between April and June.

Keep an eye on the similarities between the Dow Jones stocks and the Dow Jones itself, because they could show the signs that’ll help you rake in two-week profits of $932 over and over again.