This could be the easiest $6,000 you’ve ever made. Using this simple pattern, you could be raking in gains like that left and right.

This could be the easiest $6,000 you’ve ever made. Using this simple pattern, you could be raking in gains like that left and right.

And I’m about to expose you to this pattern. If you’ve been reluctant to jump into the stock market, this simple trading pattern will coax you right in…

One look at this and you’ll understand exactly what I mean.

In this week’s WSI TV episode, we showed you a simple trading pattern that virtually guarantees your profits.

We outlined the inverted head-and-shoulders pattern that seems to work every time. I’ve never lost money using this simple pattern.

But this simple trading pattern has an alternate version that could be even more profitable.

The inverted head-and-shoulders pattern we showed you is great in a bull market, but what should you do when the market decides to correct or even turn into a bear market?

We use the standard head-and-shoulders pattern.

As we mention all the time, short-selling stocks is extremely simple (consider it as buying in reverse), and it can be much more profitable. Hence the old saying, “the bull climbs up the stairs, while the bear falls out of the window.”

A bull market is gradual and stable, while a bear market is erratic and happens fairly quickly.

But that’s great for us, as we have the ability to short-sell.

So, what exactly does a standard head and shoulder pattern look like?

Take a look at the chart below of Abercrombie & Fitch (ANF).

As you can see, I’ve outlined each shoulder in blue and the head in red.

With the inverted head-and-shoulders, you always want the head to be lower than the shoulders, but in this case, when flipped right-side-up, you want the head to be higher.

The bases of the shoulders will form a neckline (which I’ve drawn in green).

Once you’ve spotted one of these simple patterns, the trick is to act when the stock crosses below the neckline.

In this case, you would’ve short-sold ANF around $21.50 when it crossed that neckline, and you’d still have your trade open today—looking at a 55% gain (or a $6,000 payout if you would’ve short-sold 500 shares).

The chart clearly depicts just how quickly the stock falls once it ducks below that neckline.

This pattern isn’t just found in regular stocks. In fact, I’ve found a perfect example of it for anybody who’s interested in forex trading (currency trading).

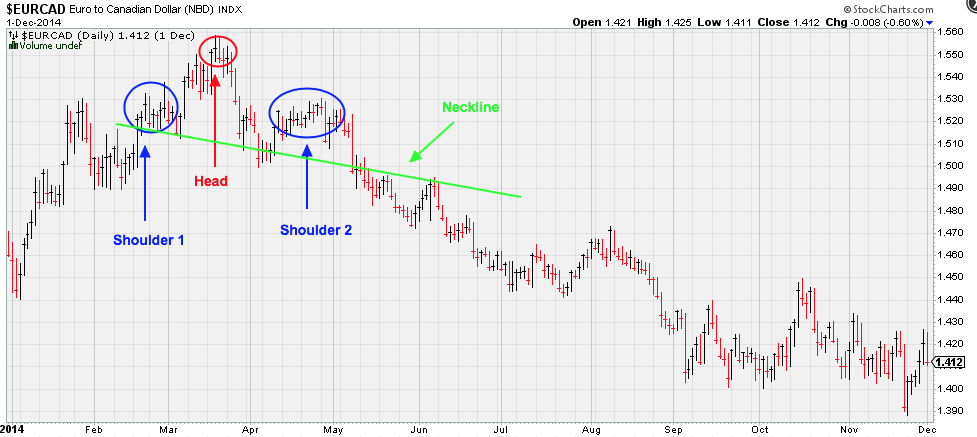

The chart below shows the exact same pattern in the chart for the Euro to Canadian dollar index ($EURCAD).

In a similar fashion, I’ve outlined the shoulders in blue and the head in red. You can also see that familiar neckline in green.

It’s fairly clear where you would’ve short-sold this index, $1.48, and you would’ve closed this trade at $1.38, just 6 months after.

That’s an annualized gain of 16%.

I dare your fund managers to even come close to these returns.