So, it’s finally here. The Dow Jones Industrial Average (DJIA) broke it’s 20,000 milestone and your prayers have been answered.

So, it’s finally here. The Dow Jones Industrial Average (DJIA) broke it’s 20,000 milestone and your prayers have been answered.

I’m sure by now you understand the weight that’s carried by this immense landmark, but are you positioning yourself to where you can make the maximum potential profit?

Probably not, but that’s ok, because I was in your position before I realized that there’s more money to be made by carefully examining the DJIA.

I’ll map it out for you, because it’s not very often that Wall Street offers such a valuable gift as this, but you’re reading this just in time and you’ll be amazed at how much cash Wall Street is willing to stuff under your mattress…

The time has finally come for investors to rejoice after a long period of rattled nerves and cold sweats.

The Dow 20,000 isn’t just a milestone for the stock market, it’s an indication that the economy has hit new highs in the past year.

As we’ve learned before, the economy expands and contracts naturally, but occasionally it has the ability to snap one way or the other like an elastic band.

This is usually labeled as a negative quality for those who watch the status of the economy closely, but for the savvy investors and traders on Wall Street, it’s just another stock market tool that can be used to make profit.

For a little while now, the stock market has been repeatedly stretched to new heights, creating a lot of tension along the way.

The Completion of this new milestone changed the perspective of many people.

The naysayers who pledged the Dow would crash before breaching 20,000 seem to have changed their rhetoric to the tone of “the greatest bull market in history is imminent.”

Those who cheered and inspired the Dow to crossing the 20,000 line are a little shell-shocked by the news. They don’t know whether they should be looking up or down—Dow 30k? Or Dow 5k?

It could honestly be either, but the result of this new milestone will be something that stuffs your mattress with cash either way.

All the hype reminds me of two key points that successful trading/investing expert Stan Weinstein points out in his influential book Secrets for Profiting in Bull and Bear Markets: the swing theory and his method for spotting an upcoming bear market.

The swing theory is a tool that Weinstein uses to predict the depths and heights of a single stock. This method can be used for stocks, bonds, ETFs, or even major indices.

The idea behind the swing theory is that if you look at a stock’s chart, you can determine a central line that the stock passes each time it changes direction.

If it passes this line on its way down and turns around 20 points below the line, the theory states that it’ll soon pass the line again and peak at 20 points above the central line.

This isn’t one of his primary trading techniques, but he states that it’s a strong indication of how a stock may act.

I can vouch for this theory as I see it happening all the time. Again, I wouldn’t make a trade based on this theory alone, but I would certainly use it amongst other techniques to help with my analysis.

Applying this theory to the DJIA alone won’t allow you to predict when the market will turn, but it’ll have some indication of how drastic the swing could be.

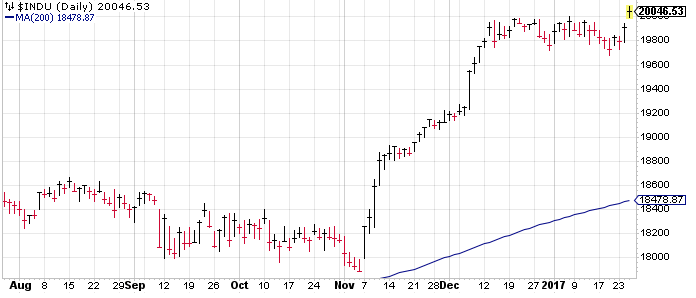

Take a look at the DJIA chart below.

Without getting too technical, we can use the 200 day moving average (the blue line) as our central line.

The DJIA is currently sitting around 1500 points above that line. If the elasticity of the index is stretched too far, there’s a big chance it could be thrown as low as 1500 points below that line.

That would be a major 18% loss that’d devastate the market drastically.

The other relevant point that Weinstein makes is that the stock market will only become a bear market when everybody stops talking about the bear.

I’m seeing it already. The Dow 20,000 hits, and everybody is claiming that we’re about to see the biggest bull market in history.

I’m not saying that this definitely won’t happen, but why not set yourself up for major profits either way.

And now I’ll get to the good stuff…

How can you PROFIT from the market in either scenario?

Well, you can buy the market, or sell the market, and it’s really that simple.

You don’t have to pay $20,000 per share, or short sell anything in order to do this.

For example, an ETF like IYY which has gained 12% in just 3 weeks is an index that includes stocks from the Dow Jones at an affordable price. It’s chart movement follows the DJIA chart movement, so you can profit immensely if the biggest bull in history is around the corner.

You can also profit by shorting the market, without even knowing what short-selling is.

If you buy DXD, you are betting against the health of the market. DXD is currently looking a little drab because of the current success of the DJIA, but once the DJIA eventually drops, DXD will soar through the roof and your profits will be made at the expense of the greedy bankers who pushed the market too far.

We always pursue a common theme that revolves around the idea that there’s money to be made in either market, and it’s something that I’ve specifically done.

Of course, a market crash is bad for the economy, but it’s also natural. You don’t have to let it ruin your finances, though. With these simple techniques, you’ll be raking in the profit while everybody else loses their head over the free-falling market.