Insider trading has such a bad rep.

Insider trading has such a bad rep.

Granted, most times it’s warranted, but there are other times when people in companies genuinely just want to make money off their stock.

Since you and I share the same desire, I can’t really blame this insider for their 1,500-share purchase last week.

Their $413,560 subtotal could make you $18,987 scotch-free.

And the best part is no matter how much money you have right now, I would bet that the key to this profit is already in your wallet.

If you open up your wallet and look through your cards, I’m sure you’ll find the MasterCard logo somewhere.

If you open up your wallet and look through your cards, I’m sure you’ll find the MasterCard logo somewhere.

With 191 million cards in circulation in the U.S., and 576 million cards globally, the chances that one has found its way into your life are incredibly high.

Whether you have a debit, credit, or gift card, MasterCard has used them to become a household name.

So, what does MasterCard’s commercial reach mean for you?

Profits. Let me tell you how.

This past week, Director Uggla Lance Darrell Gordon purchased 1,500 shares in MasterCard, which trades under the symbol MA.

That purchase equated to $413,560.

I don’t expect you to write a check to match that contribution.

The best part about monitoring insider transactions is that we can follow the movements they make and get deals better suited to our needs.

What MasterCard and its inside investors offer you are stable gains.

The track record on MA is ridiculously sturdy.

That’s because although we think of MA as a credit card company, in actuality its revenue is generated from fees.

These fees are paid by customers, like you and me, for using MA’s services (AKA their cards).

The distinction that MA is a “technology company in the global payments industry” basically guarantees that it’s here to stay.

It was created in response to what would eventually become Visa (V), one of its top competitors.

Another good sign for MA in the future is its involvement in Facebook’s proposed cryptocurrency, Libra.

While digital payments are becoming more and more complex, I can’t say for sure if cryptocurrency will overtake the tried-and-true MA methods.

What I can say is MA is smart to get in on cutting-edge technology early.

Their support of the experimental currency shows not only the company’s willingness to move forward, but also their dedication to providing strong returns to their investors.

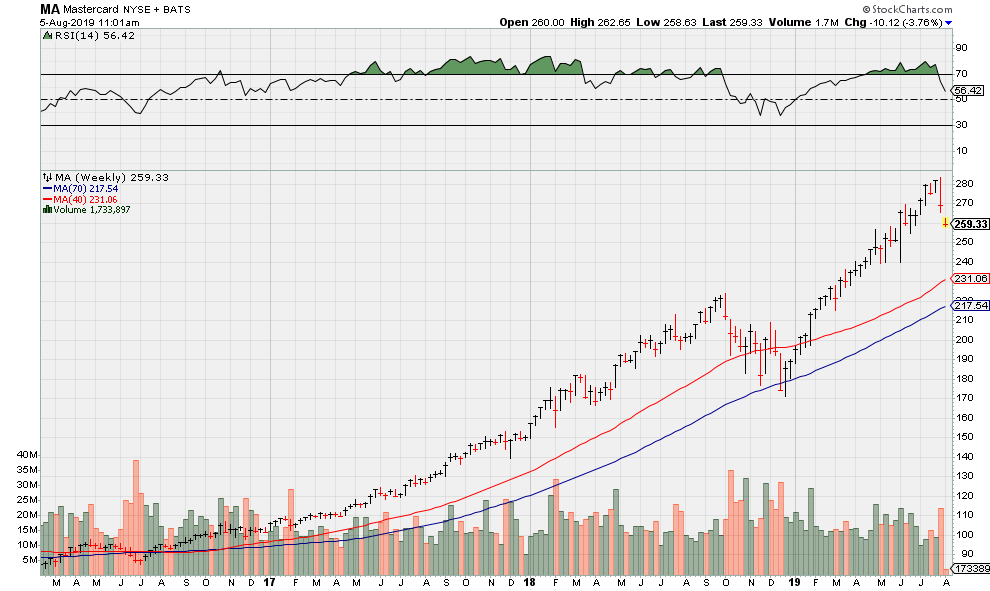

Look at their chart for a second.

A well-timed investment would have brought you $18,987 in cash to keep those MasterCards company in your wallet.

As we look into the future of currency, and investing in general, we need companies that have a healthy portion of both on their plate.

In this case, it looks like our insider was right to buy into this tried-and-true money maker.