Did you know, as you’re sitting reading this, there’s unclaimed checks are waiting for you?

Did you know, as you’re sitting reading this, there’s unclaimed checks are waiting for you?

Big banks like Bank of America and Capital One are holding them and I’m not certain how much longer they’ll keep them, but I’m going to show you how you can claim them without leaving your house.

Thousands of other people will be grabbing theirs, and once these banks are done with the payouts, your checks will be gone for good.

Here’s how to get them…

In Monday’s episode of WSI TV, we showed you how you can claim your compensation checks from the Wells Fargo scandal, but they aren’t the only banks that are holding checks for you to claim.

As I said, big banks like Bank of America and Capital One are holding these checks, and those are the two we’re going to be focusing on right now.

I’m sure you’re wondering why these checks are waiting for you… and to explain that, I’m going to introduce you to the financial sector as a whole.

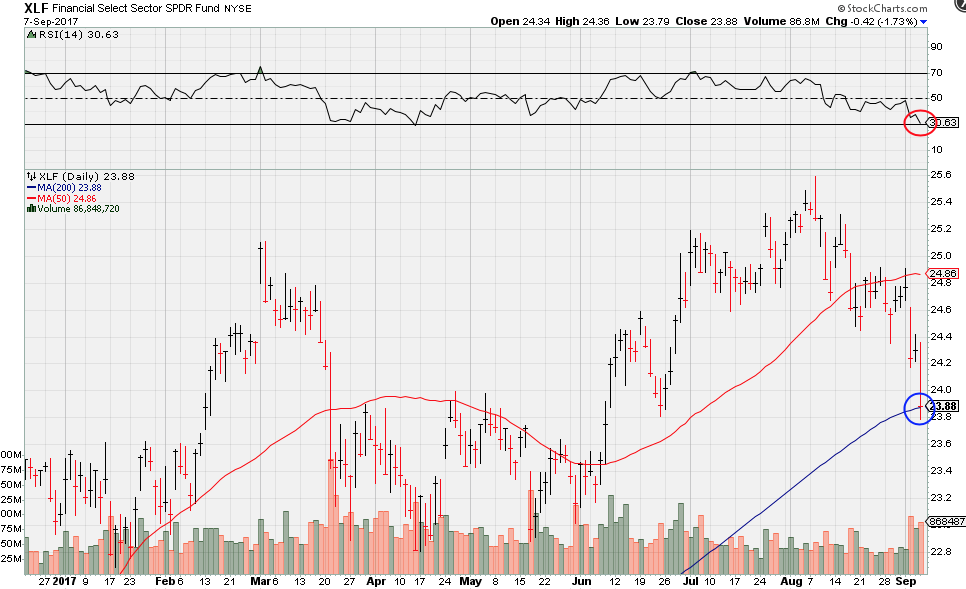

Take a look at this simple chart of XLF (Financial Select Sector SPDR Fund) below:

I’ve circled two main factors on the right side of the chart.

Now, don’t feel overwhelmed by everything going on in this chart, because you’ll soon see how simple it is.

I’m sure most of you recognize that blue line in the bottom right corner of the chart…

It’s the 200-day moving average (DMA).

If you’ve been reading these articles for a while, you’ll know how we like our stocks to remain above that 200 DMA.

But the signals I’m getting from XLF tell me that the financial sector could be approaching a critical time—as I’ve outlined with the blue circle.

As that stock prices bears down on the 200 DMA, banks will start getting ready to hand out your paychecks.

The other factor—that I’ve circled in red—comes from the RSI. The RSI is basically a strength indicator and, as you can see, XLF’s strength isn’t doing so well.

The fact that the RSI is so low and the 200 DMA is in danger of being breached tells me XLF could be in for a rough time.

And when that breach happens, you’ll be in prime position to snap up these checks.

In order to grab these checks, we’re going to turn to Bank of America (BAC) and Capital One (COF).

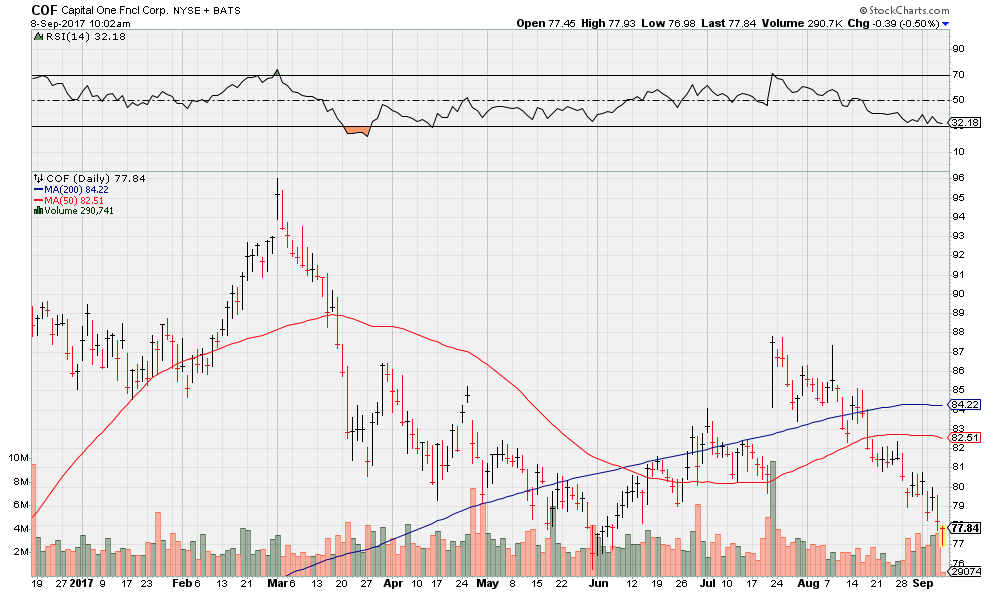

Here’s the chart for COF:

You can see that this stock has already broken down below its 200 DMA.

If you remember the chart for Wells Fargo (WFC) we showed you in yesterday’s episode, you’ll notice the similar pattern.

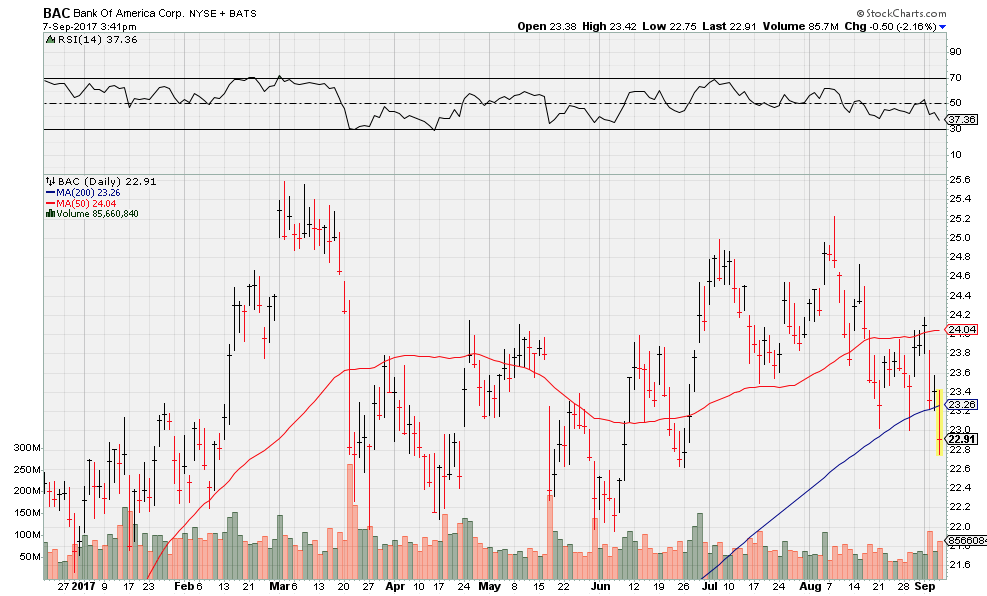

Now, here’s the chart for BAC:

Again, this one has also broken its 200 DMA.

Now, in order to cash in those unclaimed checks, I’m going to have to give you a brief and simple lesson on short selling.

Please don’t be alarmed. It’s all very easy.

Think of short selling stocks as exactly the same as buying stocks, except you want the stock to go down.

And that’s really all you need to know.

How to claim these unclaimed checks…

For you to be able to claim these checks you’re going to want two things to happen.

1. You’ll want to see Bank of America and Capital One pull back up toward their respective 200 DMAs.

2. You’ll want XLF to break through its 200 DMA.

If both of these things happen simultaneously, you’ll short sell COF and BAC, and wait for the perfect moment to exit these trades.

That’s exactly how you claim these checks from Bank of America and Capital One.