You’re constantly being told that the market is doing this because of fear and it’s doing that because of greed, but that means nothing to your bank account…

You’re constantly being told that the market is doing this because of fear and it’s doing that because of greed, but that means nothing to your bank account…

The question I’m going to answer for you is how you can profit from market greed/fear, and it couldn’t be any easier.

I’m going to show you how you can see fear and greed laid out in a chart, and how you can trade a specific stock based on investor greed/fear, so you can take your emotion-free payday.

After carefully considering the amount of greed and fear in the current market, one thing has become obvious to me: there’s a massive payday in the very near future, and it’s going to come from watching the change from investor greed to investor fear.

Right now, we’re investing in a market that’s full of investor greed. In fact, you could say that greed is at a 10-year high.

Before I get into how you can profit from this transition, let me show you how I measure investor greed/fear in a simple chart:

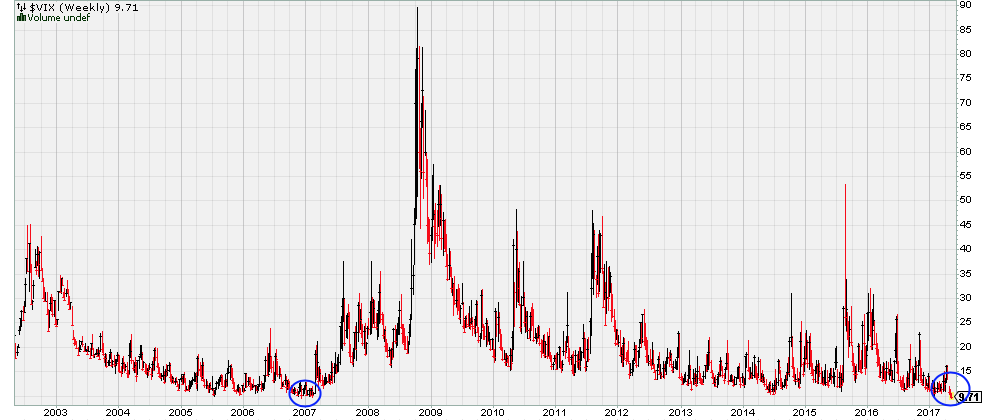

The chart above is of the Volatility Index ($VIX)—or the VIX. The VIX measures the amount of volatility within the S+P 500 ($SPX). When volatility is high, fear is generally high, and when volatility is low, greed is generally high.

After looking at this chart, I noticed that something very interesting has recently happened.

You’ll notice that I’ve drawn two blue circles on the chart. The circle to the right-hand side is the current measure of the VIX, and the circle to the left is the measure of the VIX back in December 2006.

In December 2006, the VIX hit 9.70—its lowest point since December 1993. It then went on to reach heights of 89.53 within the next 3 years.

But on Tuesday, the VIX surpassed that new low and hit 9.56—the lowest the VIX has ever been since its inception in 1990.

This new low means that greed is running the market, and the volatility in current market conditions is extremely low. But history will tell us that the stock market doesn’t like to remain in one place for too long.

You can see exactly that by simply looking back at that chart above. The volatility measure moves frequently.

And this is where we’re going to get our big payday from.

You see, you can’t directly trade the VIX, but there is an exchange traded fund (ETF) that tracks its every movement.

The ProShares VIX Short-Term Futures ETF (VIXY) tracks the movement of the VIX in a tradeable ETF.

When the VIX reached those drastic highs in 2009, VIXY reached up to $2,868. If you traded it at the right time, and it reached those heights again, you’d be collecting a 25,972% gain.

Trading 100 shares of VIXY at its current price would score you a payday of $286,800!

I have yet to see the perfect entry point to get in on VIXY, but I can assure you that if you’re subscribed to Highfliers Hotline, there’s a good chance that you’ll be seeing this trade in our upcoming recommendations.

As always, we’ll provide you with the perfect entry price and time, along with our trusty stop loss.