The streaming space is slowly becoming more and more crowded.

The streaming space is slowly becoming more and more crowded.

Netflix (NFLX) is no longer the only one calling the shots in the business of digital movies and TV shows.

Other companies, like Amazon and Hulu, have entered the playing field, but neither have presented any real competition to the original content that Netflix has to offer.

That’s all about to change though…

Possibly the most iconic name in the film industry just announced plans to kickstart their own streaming service and it’s almost sure to give Netflix a run for its money.

Any guesses on who’s behind this up-and-coming entertainment platform?

Here’s everything you need to know about the company and how shareholders are already profiting from it.

The Walt Disney Company (DIS) is the one to blame for throwing a monkey wrench into the gears.

Things were running smooth in the world of “Netflix and chill” until Disney came along and presented a new and improved version of what we’ve all grown accustomed to.

Not only has the company been around since the early 1920’s, but over the course of those 96 years its managed to acquire the rights to Star Wars, Marvel and even ESPN.

The list goes on and on, but my point is that Disney’s streaming service, Disney+, is pretty much guaranteed success from the get-go.

That’s because out of all the assets owned by Disney, there’s bound to be at least one that appeals to their wide-ranging customer base.

They essentially have all the bases covered, offering content from Snow White and the Seven Dwarves to Monday Night Football.

On top of that, they have a reputable brand that’s loved by children and adults alike.

Either way, if that argument alone isn’t enough to convince you that Netflix now has real competition on its hands, then maybe all the recent activity along Wall Street will.

Almost immediately after Disney+ was brought into the public eye, NFLX shares fell close to 7%.

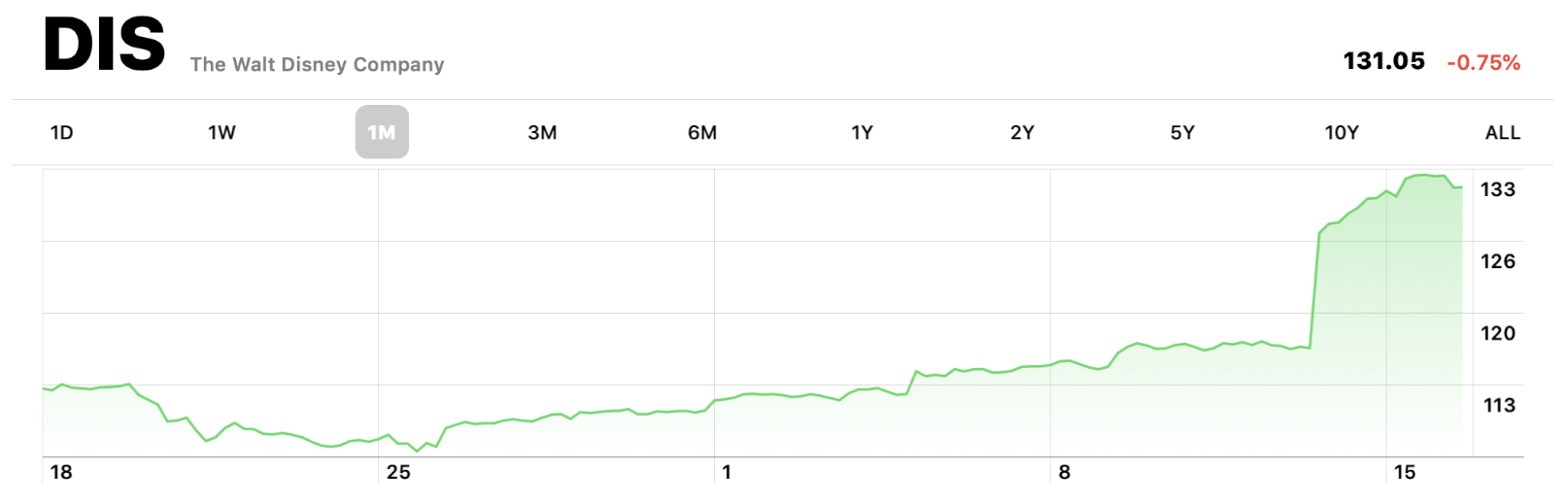

On the other hand, DIS stock has increased more than 14% in the past few trading days. That’s saying a lot for a big-name company that’s well over $100 per buy-in.

Owning just 100 shares before this price hike took place would’ve earned you a QUICK and EASY $1,630!

A lot of people don’t even make that kind of money after weeks of work!

If you’re still having a tough time wrapping your head around this increase, then take a look at the chart below.

It doesn’t take a background in technical analysis to pinpoint the exact moment DIS shares took off.

Even though stock values were already in the midst of a gradual climb up, the announcement of Disney+ pushed shares up even higher.

We don’t know a whole lot about Disney+ just yet, but we’re still half a year away from its official launch.

If you ask me, that’s more than enough time for hype to build and the market will most certainly reflect this via DIS stock prices.

In the meantime, it may be worth picking up some shares of Disney in the event of another one of these price hikes.