If you don’t live in a hurricane-prone state, you probably don’t realize how long hurricane season is.

If you don’t live in a hurricane-prone state, you probably don’t realize how long hurricane season is.

But from June to November every year, coastal states wait and see if the ocean will spit out a destructive storm. That same fear extends into Tornado Alley and Faultline towns.

Whether you’re prepared for a natural disaster or not, the stock market is going to react. Wall Street insiders have a game to make money on disasters like these, and I think it’s time they stop capitalizing on tragedies.

I’m going to tell you where they get payouts like $54,160, so you can take the money out from underneath them following events like Hurricane Dorian.

For the victims of the Category 5 Hurricane Dorian, making a profit is the last thing on their mind.

Unfortunately, there are people sitting comfortably in their Manhattan high rises watching the news coverage from the angle of how to make a buck.

The Bahamas was decimated by Dorian’s two-day hovering act, and from our office here in Winter Garden, Florida, the devastation hit a little too close to home.

Maybe it’s because such a beautiful place was destroyed by the storm, or maybe it’s because someone finally needs to chop these insiders down to size, but I want you to take their payouts away.

From the safety of Wall Street, it’s easy to distance the physical effects of a hurricane, or some other natural disaster, by looking at how the market will react.

These insiders have their hands in everything, so they’re worried which way the monstrous wind and rain will blow their investments.

In an ironic twist, you could say that at times like these they look for insurance.

Now I’m not talking about treasuries and bonds, although those are the normal kinds of insurance stockbrokers and fund managers are concerned with.

Following a cataclysmic event like the mother of all hurricanes, people impacted by the storm will be placing calls to their insurance companies once their power comes back on (if it ever does).

Once that happens, a surge of business goes to these companies who now have tons of customers cashing in on their coverage, and even new clients who need aid.

While you might think this could get expensive for insurance companies, it’s actually a huge boom in business for them.

Think about your car insurance, for example.

Let’s say you get into a car accident.

You make a claim, and your damages and/or health costs are covered. But in addition to whatever sky-high deductible you had to pay, now your insurance company has grounds to raise your monthly rates.

You’re penalized for using the insurance you already pay for, but that’s the name of the game.

The same goes for all of the future claims on roofs, cars, and even entire houses following a massive storm like Dorian.

So where does Wall Street look for a quick buck?

Big-name insurers who are about to do some serious business.

One such example is The Progressive Corporation, PGR.

Known for their unique advertising style, Progressive allows customers to bundle their home and auto insurance.

That means they’ll be getting quite a few calls about all of the floating cars and flooded homes in the next couple of weeks.

Insiders will buy into companies like PGR now, to see returns once the storm blows over.

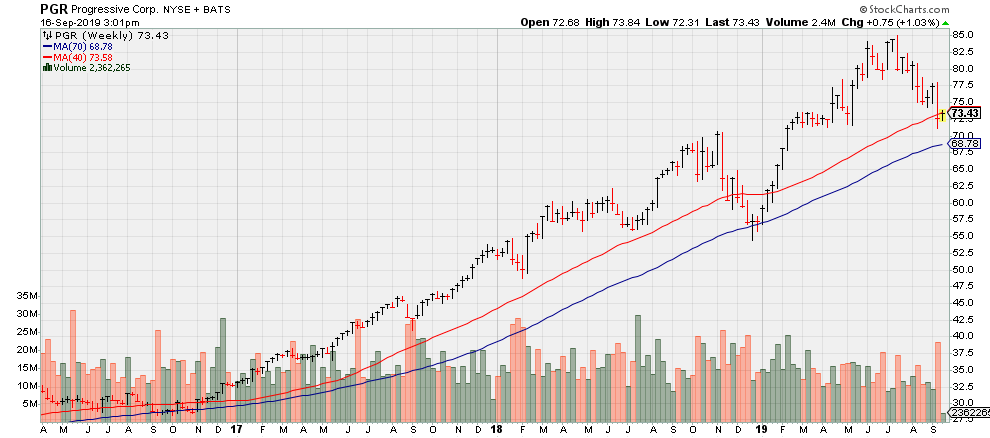

Take a look at the chart.

If you had invested in PGR once the 2016 hurricane season came to an end, you could have profited $54,160 in the meantime!

But why am I asking you to think about profits after a devastating event like Hurricane Dorian?

Because the money from a good pick like this should go towards people who actually need it, not for some Wall Street titan to buy another yacht.

Don’t let them take advantage of people left without their homes and cars any longer.

Allow moves like this to be your insurance no matter what kind of natural disasters come your way.