Does a $12,000 bonus sound like something you’d be willing to accept? What if it was gifted to you in no more than two weeks?

Does a $12,000 bonus sound like something you’d be willing to accept? What if it was gifted to you in no more than two weeks?

Imagine looking at your portfolio when the market opens tomorrow and seeing increases of 20%, 30%, or, in the case of Nvidia, over 36%.

If you felt your stomach rumble from profit hunger while you read these percentages, then look at how we can predict these profits and feed that starving belly.

We’ll give you the information that the insiders are keeping from you, so you can expose yourself to your very own $12,000 break.

Those of you who get our Midas Wave Alerts will have predicted the arrival of the new kid in town that goes by the name of Nvidia (NVDA).

If you bought into Nvidia when we recommended, we’ll congratulate you as you reaped the benefits of that 25 point jump we saw in the past week!

Don’t worry if you didn’t catch that high-flying stock, there’ll be plenty more. Learn from your mistakes and use this as an example of how effective our methods for picking the right stocks at the right time are. History WILL repeat itself.

We’ve been watching Nvidia for a little while now as it started to show potential as early as February.

How we caught Nvidia…

For the sake of relevance, we’ll only take this chart back as far as the end of last year, as that’s when Nvidia’s previously docile stock started to make waves.

Let’s get a visual of this stock’s movement:

BLACK LINE: the price of the stock

BLUE LINE: the stock’s 10 week moving average (10 wma), which is the average of the price of the stock in the past 10 weeks

RED LINE: the stock’s 40 week moving average (40 wma), which is the average of the price of the stock in the past 40 weeks

As you can see, NVDA spent a fair amount of time declining from $34 to $26 between December and February.

If we look closer into the first week of February, we’ll be able recognize a tell-tale sign that this stock has the potential to turn itself around and head toward profit—it bounced right off the 40 wma.

Usually when a stock bounces right off one of our moving averages, it’s indicative of a strong moving average. It’s a line that we can trust.

Now, while this isn’t enough for us to jump into a trade, it’s a good sign of what might happen in the future, but we would like to see more bouncing off the moving average before we send you on your way to that $12,000 profit.

Let’s move forward…

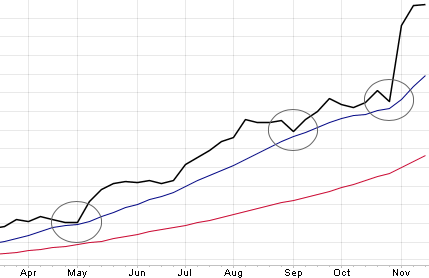

It’s fairly obvious as we head into May that our 40 wma bounce sent this stock up a few pegs, but unless you’d prefer small profit let’s allow for some more positive movement.

As you can see above, the stock kept rising after each bounce sent it along its way. At this point we see the stock bouncing off the 10 wma before rising again 3 times.

Now we’re looking at a strong stock with some solid momentum. But let’s take a better look to find out when the sweet spot to buy is, and you’ll be on your way to that $12,000 profit in two weeks.

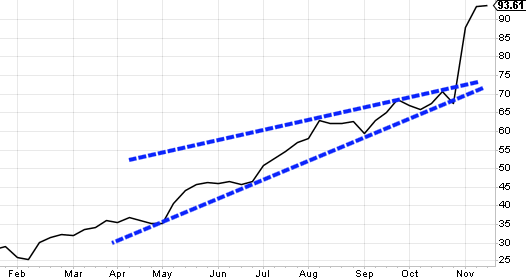

These two blue lines I have drawn are called trend lines. You can see that the price bounces off these trend lines in a very similar fashion to the way it bounces off the moving averages.

This technique was one of the reasons we suggested to buy NVDA at $68.50 per share. It bounced off $66.58 on October 31st and from there the sky’s the limit.

Now it wouldn’t be fair to give away the other two techniques that aligned for us and made this stock a hot pick, but those familiar with Codebreaker will be able to note a couple other patterns in these charts.

In fact, the profits from this stock will have easily paid for Codebreaker and all the invaluable secrets that it provides, while leaving enough cash for a nice little vacation for you and your family. Just look at the numbers.

Those who bought in at $68.50 are looking at a 36% profit in less than 2 weeks. If you bought 500 shares at the perfect moment pointed out by us, this move would’ve yielded you a profit of at least $12,000.

The profits on this stock meant a new car or even retirement for some people.

A standard “buy” would’ve brought in a profit like the one mentioned above, but if you played your hand with Nvidia’s “options”—something we also cover in our Midas Wave Alerts—you could’ve easily tripled your money!

What information did the insiders have that we didn’t?

After this stock made its monumental climb, Nvidia announced some massive partnerships which explain the fundamentals behind the rise.

Since the increase in price, Nvidia has partnered with Google, Microsoft, IBM, Tesla, the National Cancer Institute, and the United States Department of Energy. These aren’t exactly small companies to partner with.

This stock is evidence that there’s an elite group of people, the Insiders, who know about these sort of deals long before you and I hear about them.

Does it matter that they knew before us?

NO.

Why not?

Because our trading techniques outline all the hints that the insiders unknowingly leave behind. All of the information we need lies in the charts. When these deals are finally announced, we are already in the money. We have already cashed in and left the bank with our $12,000 profit.

There are thousands of opportunities exactly like the Nvidia example. These types of charts cross my desk every single day. The sooner you see that our techniques are making a lot of people rich, the quicker you’ll be walking away from a trade $12,000 in profit after two weeks.