2018 has already seen the stock market make some of its wildest jumps up and down in years.

2018 has already seen the stock market make some of its wildest jumps up and down in years.

While that can seem intimidating, there are still plenty of opportunities for profiting, no matter what the stock market does.

Luckily for you, I’m here to break it all down for you and make sure you receive your biggest paydays with the least amount of effort!

While Wall Street as a whole has been quite volatile, certain industries have been hit even harder.

You’ve probably heard a lot about the recent Facebook scandals and the concerns with digital privacy.

All of that has combined to create a very volatile market for the tech industry.

Now, that volatility can create some interesting opportunities to place certain tech stocks into prime buying positions.

However, the difficulty there is that the volatility can still make stocks harder to predict than usual.

So, for our immediate profit-gaining purposes, I’ve looked to another industry: finance.

Now there has been a lot of debate in the news lately surrounding finances, including the Federal Reserve and interest rate hikes for the year.

However, despite all of the politics and concerns of a trade war, finance can usually hold up against those concerns– no one’s putting tariffs on currency.

Because of that, the financial sector as a whole has been holding up a little more steadily than other industries.

That’s not to say anything dramatic—if you look at the stock charts for the technology sector (XLK) and for the finance sector (XLF) they look very similar.

You have to dig deeper, though, and really get into the minds of other investors.

Luckily for you, of course, I do that for you so all you have to worry about is cashing out your profits.

One particularly good-looking finance stock is Ameris Bancorp (ABCB).

A couple weeks ago ABCB was in a much pricier position, and I wouldn’t have looked at it as a good buy at its price point.

Thanks to the recent market activity, though, ABCB has been pulled down just enough to put it in a much more appealing position.

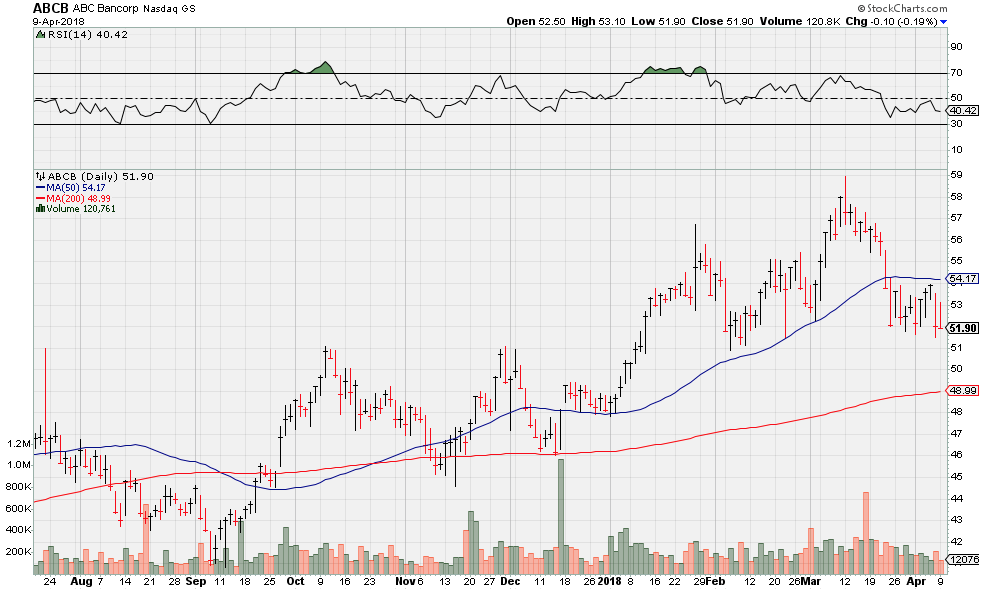

Let’s take a quick look at the daily chart for ABCB.

We can see that ABCB has been respecting the 200-day moving average lately, and more importantly, we see that a line of resistance starting back in October 2017 became a line of support in 2018.

It’ll be interesting to see what ABCB does in the near future, but it’s a good sign that, besides that initial drop in mid-March, ABCB has held steady despite the recent volatility.

Whenever there are significant movements in the market, it’s very telling when you find stocks that have not been pulled down with the market.

Stocks like ABCB that manage to hold their ground as everything else tumbles are especially attractive, because we can hope that they will perform even better once the market returns.

No matter what’s happening in the market, there will always be ways to make a profit.

Don’t miss out on a huge payout just because it seems like everyone else is!