Aren’t you sick of following some of the world’s biggest companies down a deep financial rabbit hole? Wouldn’t it be nice if you could tell when a company is floating solely on shaky accusations?

Aren’t you sick of following some of the world’s biggest companies down a deep financial rabbit hole? Wouldn’t it be nice if you could tell when a company is floating solely on shaky accusations?

Luckily for you, we’ll show you some vital yet obvious signs of companies that are running on fumes so you can preserve your $7,000 profit.

If you’ve been following the financial news lately, you’ve probably seen all the hype about Deere & Co. (DE) that’s been floating around. But how can you really tell whether all the information is credible or if it’s just speculation that’s destined to fall?

I’m here to show you…

If you’re a frequent visitor of Yahoo! Finance or CNN Money, then you’ll know what I’m talking about when I mention all the hype surrounding DE over the past few weeks.

If you don’t visit these websites often, let me fill you in…

Post-election has been great for those companies that are on the right end of the market as Trump’s success indicates a changing economic tide.

Construction and farming companies have seen record-breaking highs in the past few weeks as the president-elect has outlined his focus on America’s infrastructure.

Because of this, companies like DE and Caterpillar Inc. (CAT) have had their names pasted all over the financial news in recent weeks, sending their stocks into stratospheric highs.

DE stock rose more than 11% on November 23rd after they released their earnings despite profits declining 17% this quarter, but just how trustworthy is the rise of DE?

If you’re asking me, which I assume you are, it doesn’t seem very trustworthy at all. Mostly because the news we see after a dramatic rise like this has already been accounted for in the numbers.

The harsh reality of the financial world is that the news we receive is always too late for us to act upon. If we traded stocks based off the financial news, we’d be chasing our tails while watching our investments sink.

But we don’t need to worry about any of that, because as I’ve said a thousand times we rely on our tried and trusted techniques to separate the healthy stocks from the malignant ones.

So, what can you do to protect any investments you may have in these hyped-up companies?

If you bought 200 shares of DE back in January when the stock was hovering around the $68 mark, you’d be looking at a profit of $7,242 if you sold your shares on November 25th at $104.83 per share.

Now that you’re seeing all this hype about DE, you might feel inclined to hold your shares based on the belief that the stock will rise because of all these positive news articles. Be aware if you’re not ready to sell and watch the stock very closely.

It has fallen drastically before and will fall drastically again.

Let’s take a closer look.

My biggest point of skepticism about DE is that the stock seems to be rising based off pure speculation that Trump WILL focus on infrastructure.

Now, I’m not questioning whether he will or won’t, I’m just analyzing the stock and focusing on the fact that it’s pure speculation. There’s no concrete foundation to back up the rise of this stock.

We always talk about how important it is to keep your emotions and personal inclinations out of your investments. This is the perfect example.

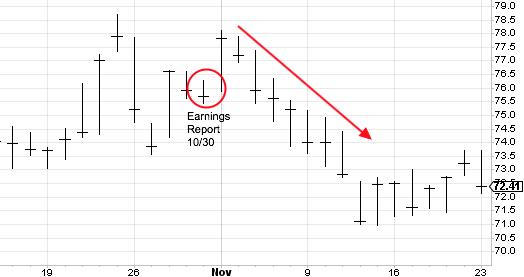

Another red flag that I’ve noticed about this stock appears when looking back at their previous earnings announcements.

Keep in mind, DE released their latest earnings very recently on November 23rd. You’ll notice a common theme when the stock rises for a short period after the earnings were announced before heading down again.

Let’s look back at their previous earnings reports…

October 30th, 2015: Earnings were announced before a short rise which led to the imminent drop.

January 30th, 2016: Again, earnings were announced before a lengthier rise followed by the imminent drop.

April 29th, 2016: Same pattern—earnings announced, steady action, imminent drop.

July 30th, 2016: Very similar pattern, with a slightly less drastic drop.

History will always repeat itself.

Right now the stock is flying, but it might be the perfect time to sell your shares for that happy profit of $7,242.

If we see this stock start to turn, which I believe we will, sell it. If it starts to drop in the same fashion as before, you could short it for a healthy profit.

If you weren’t invested in DE, it doesn’t mean that you can’t learn from this stock. There are plenty of stocks we’ve been monitoring in our Midas Premium Monthly Newsletter that could be very profitable if acted upon at the right time.

Whichever route you take with this stock, just remember: The insiders have already been in and out and have taken their profit.

Lock in your $7,000 by making the right choice.