For every game of poker, there’s a donor at the table.

For every game of poker, there’s a donor at the table.

In other words, there’s always one person with a set of cards in their hands that’s pumping more cash in than they’re taking out.

The thing is, playing cards is no different than investing in the market.

Between the big-banks and traders, such as yourself, someone is getting the shorter end of the stick and more times than not, it’s you…

With that said, I’ve listed a little trick to holding your own along Wall Street and ensuring you’re not the sucker who’s donating their money to the rest of the table.

The key here is to look for trends.

As the saying goes: “the trend is your friend” and if you can determine what direction shares are moving in, then you’ve already won half the battle.

Having an idea of what direction a company’s stock will travel next is crucial to earning the most bang for your buck.

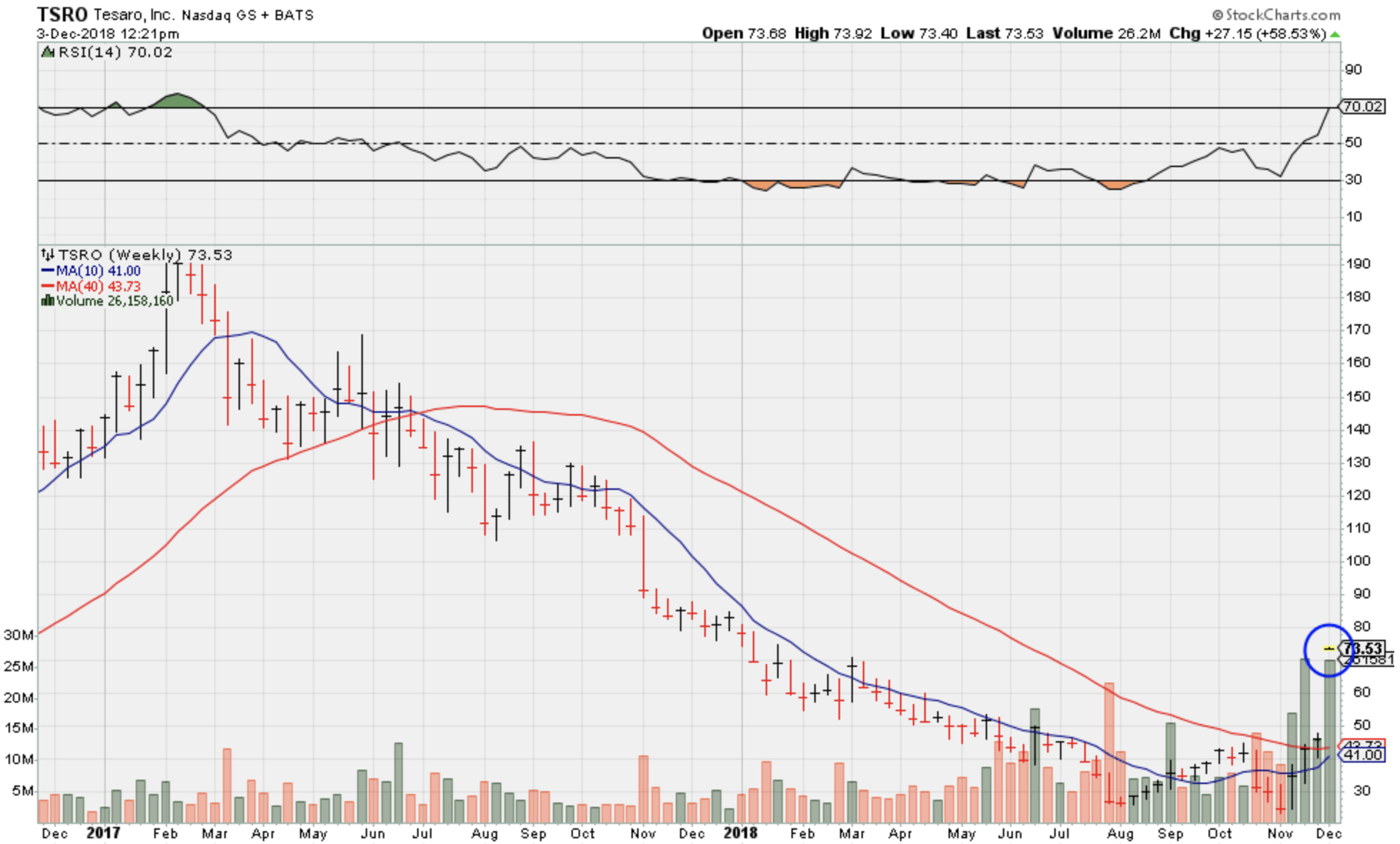

Take a look at the chart for a company by the name of Tesaro (TSRO) below…

As you can see, Tesaro share prices skyrocketed during the first few days of December. The real question is what exactly led to this sixty or so percent surge?

One explanation for TSRO’s price jump is the fact that values just recently met up with the 40 week moving average.

This red line you see depicted in the chart above is a great way to gage future activity.

Think of it as a way to call the stock’s bluff. It’s clear that Tesaro was stuck in a downtrend for about 2 years straight, but once its stock value broke even with the moving average, prices exploded upwards!

This is typical behavior once the share price and moving average cross paths.

And if you happened to catch wind of this increase beforehand, you would’ve effectively added $33.31 PER SHARE in profits to your portfolio!

That means owning 100 shares would’ve made you well over $3,000!

The thing is, most investors would’ve avoided an investment with TSRO, considering prices have consistently dropped lower and lower.

Approximately 2 years prior to this increase, prices were sitting close to $200 and it wasn’t until they hit $23.41, before the tables turned and shares hopped back up to the $73.92 it’s hovering around today.

It just shows that identifying trends and getting the timing right both go hand-in-hand with making money from the market.

Don’t fall victim to pumping funds into the market without having a gain to show for it afterwards.

Keep this interaction between moving averages and share prices in mind the next time you trade to give yourself a good idea of where the stock is heading next.

As you may have guessed, these returns aren’t always as simple as share prices overlapping this red line. The market can be a bit more complex at times…

Either way, it’s an easy trick that can help you out along the way.

But if you’re interested in receiving a more in-depth understanding of these exclusive trade tactics, then come join us at our Annual Wealth Summit just a few short weeks away!

If you’re serious about earning effortless income from the stock market, you won’t want to miss out on a weekend of hands-on training from some of our best analysts.

We believe that everyone deserves to know how to take advantage of the stock market in a way that allows them to use their money to make money.

So, why not take your trading skills to the next level?

Click here to sign up for the seminar today and start the new year off with more profits under your belt!