Wouldn’t you like to know what will happen to a stock price before it happens?

Wouldn’t you like to know what will happen to a stock price before it happens?

Sounds impossible. But with this insider pattern I’ve picked up on, it may not be…

In the past few weeks, over $12,000,000 worth of shares have been sold by a high-up insider.

But he’s done it before. Last time he sold off a similar number of shares last year, the price jumped 40%!

Now that he’s done it again, here’s how YOU can take a chunk of these profits for yourself.

If you’re a market hound or just starting out, chances are you bought into a stock bound to skyrocket, and against all odds, watched it sink lower and lower.

Most Wall Street professionals want you to think this is inevitable. Or that only they can help you curb the unpredictability of the market with fancy tools and methods.

That’s nonsense. All it takes is a keen eye and practice to navigate the market, and here’s how you can get started on the path to beating the odds.

First, I’m going to give you a bit of insider info. This is key to understanding where price jumps and drops actually respond to day-to-day activity, rather than the fickle nature of whatever investment managers tell you.

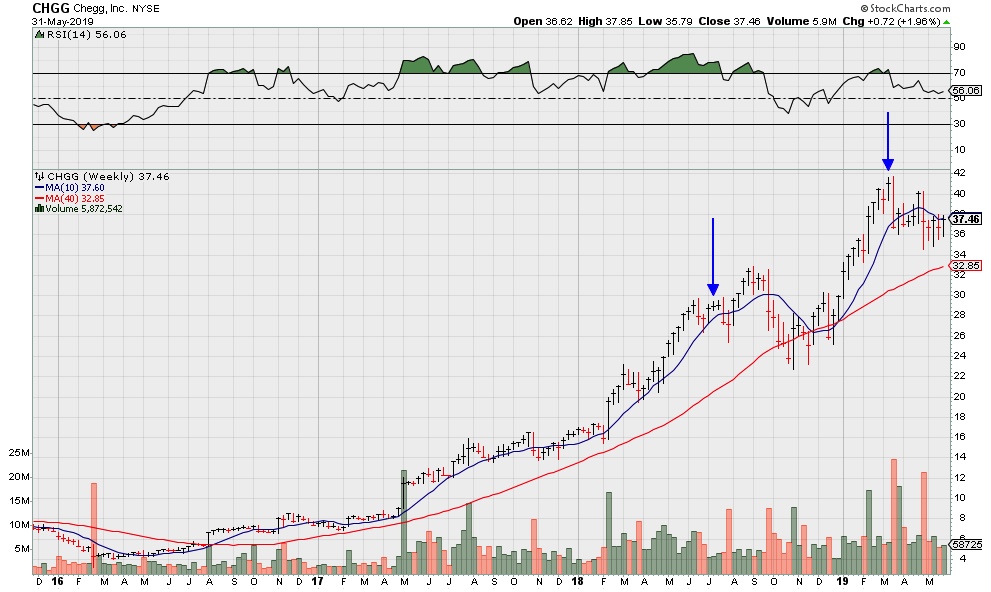

Chegg Inc. (CHGG) is an American online education company that offers textbook rentals, homework help, and other study tools.

The shares for CHGG have been on the rise since early 2017, and my indicators point to a bright future for shareholders.

There are some small fluctuations that you should be aware of, however, and insider trading like this big unloading of shares explains a lot.

Chegg Inc. President, CEO, and Co-Chairman Daniel Rosensweig sold over $8,000,000 worth of shares over two days in July and August 2018.

Right after, the price jumped almost 13 points.

If you had caught onto this insider movement at the time, you could have made $1,318 on a hundred shares.

But don’t just take my word for it. Check it out.

The first arrow points to where Rosensweig sold millions of shares, and the second to the resulting price jump afterwards.

On May 1, the exec and his buddies sold north of 150 million shares following a 12% price drop on April 30.

Running with his tail between his legs? Maybe.

But don’t let small price fluctuations freak you out of potentially major profits.

With the positive outlook for CHGG’s stock, including positive earnings reports for the past 4 quarters, chances are you should buckle up on this one.

A small investment on the back of a big insider trading deal could ride you out into profits like you’ve never dreamed.