What’s the first thing that comes to mind when you see the image of a cross?

What’s the first thing that comes to mind when you see the image of a cross?

If you’re religious, you might think “redemption” and if you’re a shareholder, then your thoughts will probably even matchup…

You see, the same way that a Christian cross symbolizes being saved from sin, a cross in the stock market can represent shares being saved from lower price points.

In other words, it’s a technical chart pattern that almost always hints towards a major bull rally.

Lucky for you, one of these crossovers has just taken place, meaning profits are expected to be right around the corner!

Let’s see what this new signal is all about and what it could have in store for investors like yourself…

You’re probably wondering what exactly a cross in the market even means.

If you want to get technical, the actual term is golden cross and it’s basically when a stock’s short-term moving average crosses ABOVE its long-term moving average.

Simple enough, right?

The important thing to remember is whenever these two lines meet up it usually signals the reversal of a downtrend.

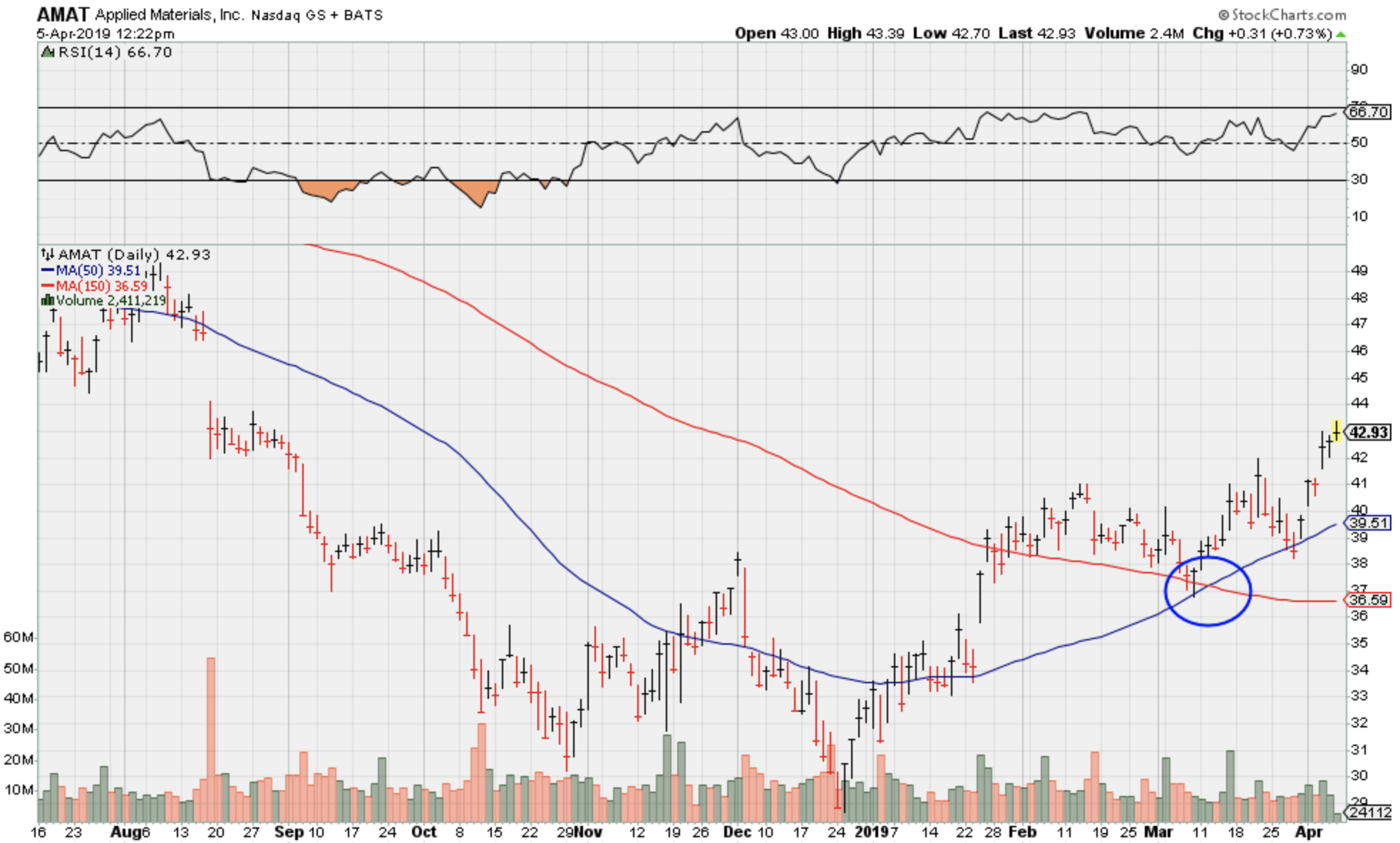

Feel free to checkout this kind of action in the chart below for Applied Materials Inc. (AMAT).

As you can see, the 50-day moving average (blue line) crossed over the 200-day moving average (red line) not too long ago.

Before that, shares were relatively flat, but now that this golden cross is underway, values have since taken a huge leap!

And this is just the beginning…

As prices continue to climb up these moving averages will move further and further away from one another until they start to form support levels.

Even though AMAT is the priciest it’s been in the past 8 months, you should still expect to see shares climb even higher from here on out.

Don’t just take my word for it though.

Back in 2015 when Netflix (NFLX) was making its mark on Wall Street, its share price shot up as much as 120% from the effects of a golden cross.

So, who’s to say that Applied Materials Inc. doesn’t have the potential to do the same?

Go ahead and add golden crosses to your technical analysis toolbox and see how they add quick and easy profits to your portfolio.

Even if a stock is spiraling down, big returns could be closer than you think if the short-term moving average is about to cross above the long-term moving average.