When investing, we want to get our hands on the strong stocks that can’t go anywhere but up!

When investing, we want to get our hands on the strong stocks that can’t go anywhere but up!

Unfortunately, those stocks are usually already quite expensive, and can be a bit nerve-wracking for solo investors.

With my help, a better option is to find stocks that have had high highs before plummeting to low lows, but are looking to rocket back up.

If you’re able to identify these stocks, you can come into huge profits (say, an 80% profit overnight!) for only a small investment.

Like a phoenix rising from the ashes, Fossil Group (FOSL) made astounding gains after announcing better-than-expected fourth quarter earnings.

The news comes after 4 years of Fossil struggling and seeing serious and continuous decline.

FOSL has some excellent potential to be a high-earning stock.

Just four years ago, shares of FOSL were at $140 each.

Unfortunately, over the last four years, FOSL stock tumbled and has been around $9 per share.

That is, until their earnings for the fourth quarter were released on February 13th, and FOSL stock skyrocketed 80% overnight!

The stock closed on the 13th at $9 and opened on the 14th at over $16!

Let’s take a look at FOSL’s daily stock chart so we can see just how dramatic this jump was.

If you’re having trouble finding the jump, look to the far right where the line is highlighted.

You can see that huge jump illustrated by the gap in the daily prices, since FOSL opened so much higher on February 14th than it had closed on the 13th.

Clearly you can also see quite a bit of variance in the price of FOSL on February 14th as early investors sell for a 53-80% profit, and new investors excitedly buy in after the earnings announcement.

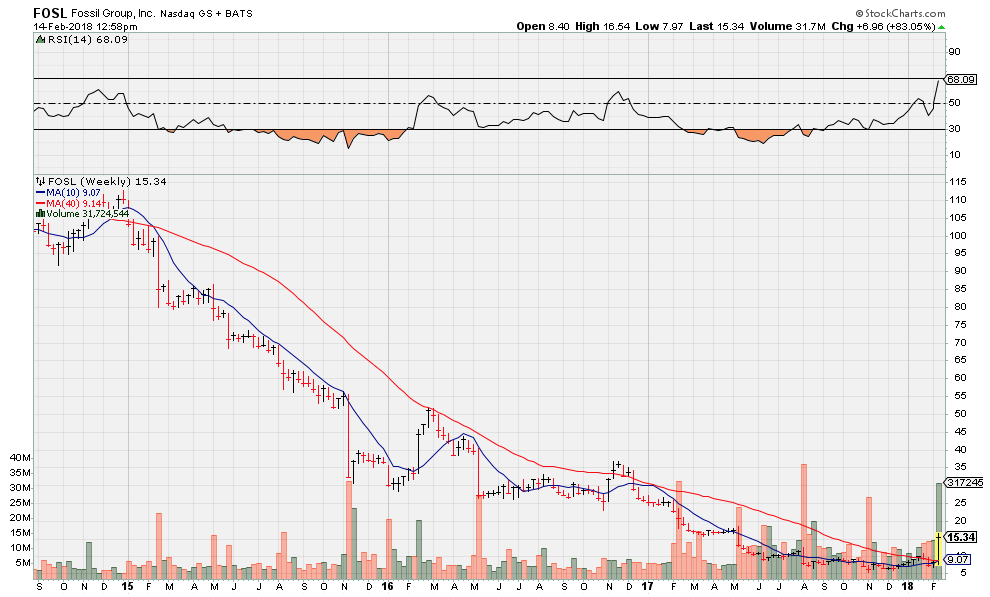

While the daily chart makes that 80% jump look like FOSL has reached new heights, looking at the weekly chart exemplifies the potential of FOSL.

In the weekly chart that 80% gain looks far less impressive, particularly when looking back to 2015 when shares were above $100 each.

However, this chart can still be a very appealing option if you believe that FOSL has the potential to continue replicating higher earnings, and essentially, rise from its former ashes.

When announcing the positive earnings, Fossil Group chairman and CEO, Kosta Kartsotis outlined four pillars of FOSL’s new strategy that had contributed to the higher earnings and would likely continue to increase revenues.

Those pillars laid out by Kartsotis were the following: advancing their tech agenda, leveraging scale to drive cost out of their supply chain, becoming digitally enabled, and continuing the transformation of their business.

The problems FOSL has faced have largely had to do with keeping up with new technologies, and a decrease in people wearing traditional watches.

To combat that, FOSL teamed up with several big-name designers, including Michael Kors, Tory Burch, Kate Spade, and Armani, to release watches for the designers while still maintaining the quality of Fossil.

Additionally, FOSL has made strides in their wearables department, selling smart watches and accessories that hook up to people’s devices, and can track their fitness activity and heartrate.

Although they still have a way to go to return to their former glory, FOSL has been making excellent strides in that direction, and could become a powerful stock.

If you want to get into a strong stock at a low price, FOSL may be the perfect option.

Don’t miss out on another overnight 80% payday!