The great American inventor Thomas Edison left behind a $261.2 billion goldmine, and I’ve just found a way to mine our fair share.

The great American inventor Thomas Edison left behind a $261.2 billion goldmine, and I’ve just found a way to mine our fair share.

This move that’s recently come to light could present you with a 209% gain on your capital. In fact, the potential profit from buying this stock has become so obvious that I couldn’t wait any longer to share it with you.

We all admire the legacy Thomas Edison left behind, but now it’s time to profit from it…

In New York, 1892, Thomas Edison founded a company that’d eventually come to show a huge profit 125 years later.

Edison General Electric Company was the conglomeration of all Thomas Edison’s inventions. Now known simply as General Electric (GE), we’ve been presented with a beautiful opportunity to make a 209% profit.

This profit play comes to light on the back of GE CEO Jeff Immelt stepping down.

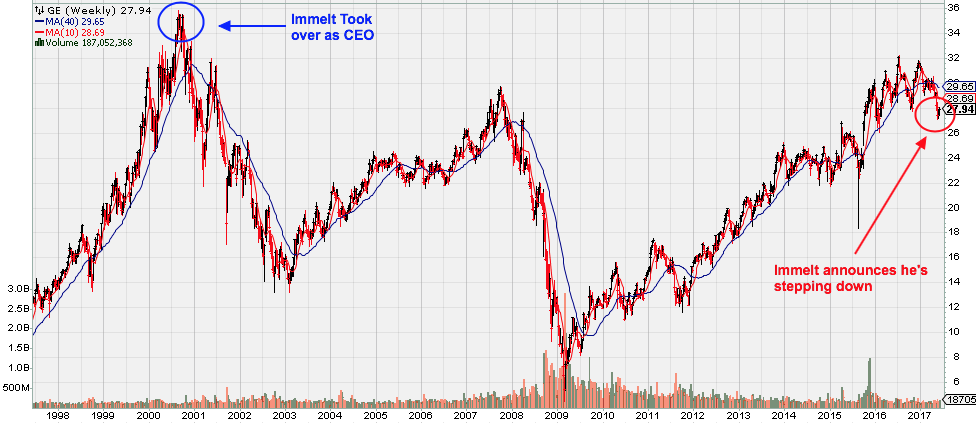

If we look at the figures during Immelt’s tenure, we’ll see that he’s had a bit of a bumpy ride, especially compared to his predecessor, Jack Welch (1981-2001), who took GE stock from a miniscule 58 cents to heights of $35—a 5,934% boost.

When Immelt took the reins from Welch in 2001, GE stock was sitting at its all-time high around $35.

Immelt then saw the stock sink to $5 during the 2009 financial crisis.

To his credit, Immelt had some of the toughest crises to maneuver through during his 16-year run—the 2001 terror attacks just 4 days after he took over and the 2009 financial crisis—but he had a lot of trouble taking the company’s stock back to the heights reached during Welch’s term.

Currently sitting around $29, it looks like GE stock could be heading back toward its 200-day moving average, which it’s been trailing since the beginning of this year.

In the past, when GE has crossed above its 200-day moving average, investors were salivating from the profits that they were taking.

For example, if you would’ve invested in GE in 2009 when it crossed above its 200-day moving average at $10.43, you would’ve taken a 209% profit in July of last year.

There was a signal that I noticed recently that could foreshadow a very big payout from GE.

Upon the announcement of Immelt’s departure, GE stock jumped 4.7% in a single day. That jump shows exactly how investors feel about Immelt’s announcement, and I doubt that the stock is going to stop there.

When Thomas Edison was incubating the egg that became the industry giant that GE is, I’m sure he knew how profitable the company would become.

Almost 90 years after his death, the profits continue to roll in.

Now that the stock is gunning to cross its 200-day moving average, we could be seeing some massive gains very soon—maybe we’ll even get a repeat of those 209% gains between 2009 and 2016.