When tracking company insiders on Wall Street, it’s true that we have a set of rules to abide by, such as insider buying is more meaningful than insider selling.

When tracking company insiders on Wall Street, it’s true that we have a set of rules to abide by, such as insider buying is more meaningful than insider selling.

While there will always be exceptions to our rules that we must watch out for, we can confidently rely on these guidelines to lead us to profits and away from insider traps.

And right now I want to give you an important rule for insider tracking that can save you from bad investments…

Although we should pay attention to a stock anytime it experiences insider trading from several company officers, directors, or 10% owners, we also need to understand that the thought process an insider may have when buying can give us a hint as to how legitimate it is.

Let me back up…

Insiders only buy for one reason—they think the price of the stock will go up and they want to profit from that rise.

But they may think the price of the stock will go up for different reasons. As an example, let’s look at Violin Memory Inc. (VMEM) and Civeo Corp. (CVEO).

Both companies just experienced insider buying by 3 company insiders that totaled more than $500,000-worth of stock. So, we can agree that these are similar situations, right?

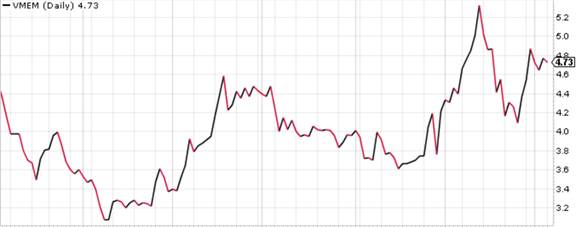

Now let’s look at the chart for VMEM from Stockcharts.com…

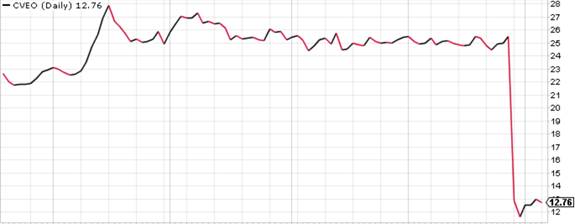

…compared to the chart for CVEO:

The only thing to note about VMEM is that it’s a penny stock, which means it could have HUGE potential, but that’s irrelevant for this lesson.

For CVEO, a big drop in the price of the stock triggered the insider purchasing…

What does this tell us?

Well, VMEM insiders may have bought on inside information that pointed to a rise in the price of the stock. Or new revenue numbers may have just been revealed that would shed a positive light on the company and stock.

On the flip side, the CVEO insiders appear to have bought stock based primarily on the drop in price. They believe their stock is currently at a discount and won’t go lower.

This is where the thought process is meaningful to us!

Don’t let the insiders lead you astray because they don’t know how to read a chart. It’s easy to tell that CVEO is an unhealthy stock, but the insiders don’t realize that.

They don’t know how stocks behave based on indicators and logic. They only see it as a bargain when the stock drops.

And another huge mistake they have made is believing the price cannot go any lower…the price can ALWAYS go lower!

So, while we can use the VMEM information as a tool to give us insight on the future of the stock, we should disregard the insider buying on CVEO because of the thought process of those insiders.

If you want to trade better than the insiders buy understanding how to read a chart to determine its likely future, check out the Stock Code Breaker course.

Click Here: Get a free Pick and the 7 Secrets to Finding Top Penny Stocks