I’ve never seen anything this consistent before.

I’ve never seen anything this consistent before.

The energy sector is handing out $600 every time this happens, and there’s no limit to how many times it could happen.

These payouts come from a specific signal that keeps getting triggered, but I’m not asking you to do anything more than click a button each time this specific signal goes off.

Here’s how you claim these $600 payouts…

Before I show you exactly how to take these payouts, I want to ease your mind a little bit.

In order to take these payouts, we’re going to be looking at a specific exchange traded fund (ETF)—the Energy Select Sector SPDR Fund (XLE).

An ETF is a basket of stocks that you’re able to trade just like individual stocks.

These funds are actively managed by experts, but you don’t have to worry about any excessive fees.

XLE, the ETF we’re going to be homing in on, is an ETF that tracks a wide range of stocks within the energy sector.

These types of ETFs are great for looking at the overall picture of a specific sector.

After careful examination, I’ve found an opportunity that’s arisen from XLE. This opportunity has been paying people $600 each time it’s shown itself—and it’s been one of the most consistent patterns I’ve ever seen.

As a technical analyst, I follow different patterns in the stock market in order to find the best profits, and this seems like it could be one of the easiest profits I’ll take yet.

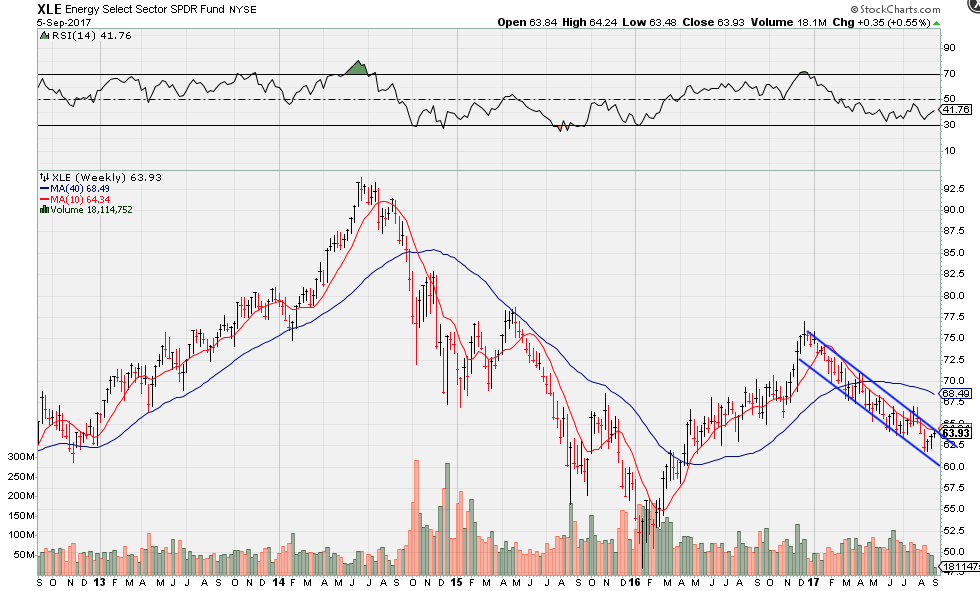

Take a look at the chart for XLE below:

You’ll see that I’ve outline a channel on the right-hand side of that chart above.

Notice how the ETF continues to bounce off the upper and lower trend lines of that channel.

The one thing that jumps out of this channel is the length of time it’s been containing the ETF.

I’ve profited of channels much shorter in length than this, but the fact that this has been going for almost a year tells me that it’s extremely reliable.

Now for the good part…

Each time this ETF bounces off the upper trend line, you could be taking in payouts of over $600!

I’ll break it down for you:

If you shorted (buying in reverse) 100 shares of XLE on the first bounce at $75, you would’ve closed your position at $69 for a $600 gain.

You would’ve then followed the same procedure at $73 (closing at $67), $71 (closing at $65), and $67 (closing at $61).

Obviously, shorting more shares would return a greater payout.

1000 shares would garnish you $6,000 each time it bounced.

These payouts have almost been too consistent to believe, but the proof is all in that chart.

I’ll be keeping a close eye on this channel, and next time it bounces I’ll be jumping on that opportunity immediately.

Keep an eye on this chart, and make sure you take each $600 payout as it hits.